Since January 2023, public and private companies have increased their reserves in the leading cryptocurrency by 448%. According to Glassnode, the volume of coins on their balance sheets has risen from 197,000 BTC to 1.08 million BTC.

The aggregated size of Bitcoin treasuries held by public and private companies has grown from 197K BTC to 1.08M BTC, a ~448% increase since January 2023.

Corporate balance sheets are becoming an increasingly significant pillar of demand for BTC.

📊 https://t.co/BG7o6axv1P pic.twitter.com/VWEiIV6lHS

— glassnode (@glassnode) December 9, 2025

Analysts have identified the corporate sector as a key pillar of demand for digital gold. The accumulation of reserves on company balance sheets leads to a reduction in the market supply of the asset.

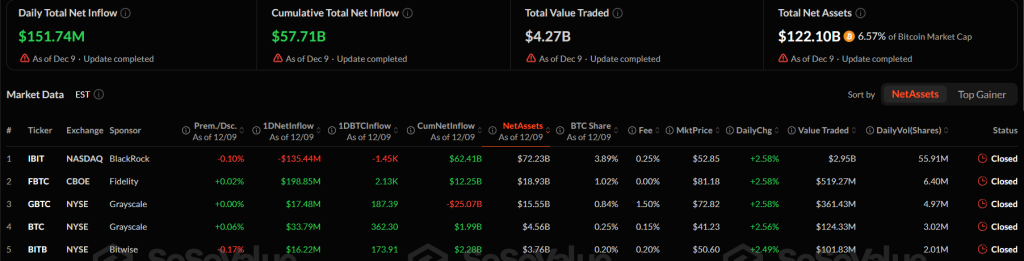

Institutional interest is also confirmed by exchange-traded fund statistics. According to SoSoValue, on December 9, the net inflow into spot Bitcoin-ETF amounted to $151.74 million. The leader was Fidelity’s FBTC with $198.85 million.

Positive trends are also observed in the altcoin sector. Spot Ethereum-ETF attracted $177.64 million, with the largest amount directed to Fidelity’s FETH fund — $51.47 million.

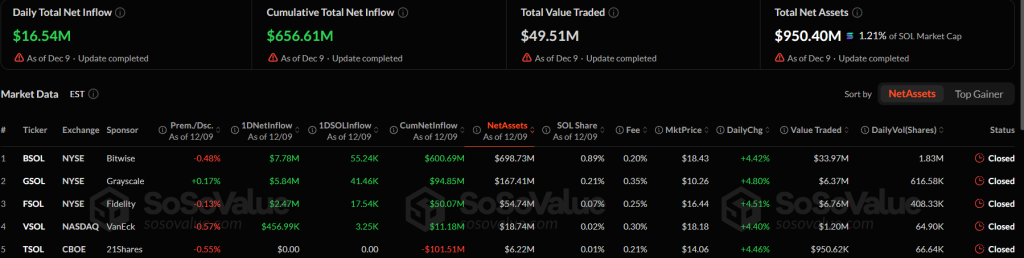

Solana-based products recorded a net inflow of $16.54 million, with the best performance from Bitwise’s BSOL at $7.78 million.

Earlier, on November 21, the supply of the leading cryptocurrency held by long-term holders reached a cyclical low.