- Jamie Coutts, Chief Crypto Analyst at Realvision, believes the Bitcoin bull market isn’t over yet despite substantial falls over the past few months.

- Coutts told the Tapping Into Crypto podcast that the weakness in crypto is due to macro conditions creating a risk-off environment but he believes Trump is likely to “goose” the US economy before next year’s midterm election creating better conditions for crypto.

- Coutts also said crypto is now at a “major inflection point” where institutional adoption will see the importance of the four-year cycle decline.

Jamie Coutts, the Chief Crypto Analyst at Raoul Paul’s financial education platform Realvision, believes there’s more upside to come for Bitcoin in the short to medium term despite the substantial sell-off since October 10.

Speaking to Ted Coaldrake and Pav Hundal on the Tapping Into Crypto podcast, Coutts said that the weakness we’ve seen in crypto markets over the past few months is part of a broader pattern of de-risking from investors and not related to structural weakness in crypto.

What we’re seeing in crypto is a macro-driven risk-off event.

Jamie Coutts, Chief Crypto Analyst, Realvision

Jamie Coutts, Chief Crypto Analyst, Realvision Coutts says this low-risk appetite is largely the result of governments’ loose spending during the peak of the COVID pandemic.

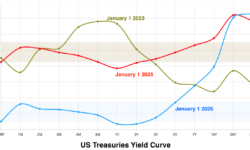

“The central banks, despite the fact that they’ve been cutting rates, have essentially been running tight monetary policy now for 3 years…and that’s just the over-reaction to what they did during COVID,” he said.

According to Coutts, this tight monetary policy, particularly in the US, is now impacting banks and leading to reduced liquidity — a situation which tends to hit risk-on assets like crypto particularly hard.

“The banking sector is now starting to show signs of real stress — the asset class that responds most to liquidity is crypto. I think that is the major reason we’re starting to see Bitcoin selling off.”

Despite these macro-concerns, Coutts maintains that it’s unlikely we’re at the end of the cycle for crypto. “I’m actually very positive on these assets [cryptocurrencies] right now.”

Coutts said ordinarily Bitcoin’s crash since hitting a new all-time high in October would signal the crypto bull market is over, but in this case, he remains confident there’s more upside based on other market signals.

We haven’t gone through an expansion phase, we haven’t gotten to the top of a business cycle, we have not seen excess liquidity — we’ve seen the opposite.

Jamie Coutts, Chief Crypto Analyst, Realvision

Jamie Coutts, Chief Crypto Analyst, Realvision Coutts also believes US President Donald Trump will put out all the stops next year to “goose” the economy ahead of the US midterm elections — pumping liquidity into the system and likely helping to boost crypto prices.

“He’s gonna do everything he can to get re-elected, they’re going to issue as many bills as they can on the short end,” Coutts said.

“This plays into my thesis around why I’m bullish. They’re going to relax rules for banks to basically buy more [Treasury] bills… this supports the government’s funding so they can spend and gives them the ability to create credit without a constrained balance sheet.”

Coutts added that he believes the Trump administration is looking to shift the power to control the US economy away from the ostensibly independent Federal Reserve to the more political US Department of Treasury.

“There’s a clear decision from the Trump administration — Bessent and Moran — that they want a lot of the liquidity levers to be moved into the Treasury away from the Federal Reserve. And so yeah, I think they’re gonna goose the markets because it’s politically what they need.”

Related: Bitcoin Holds $87.5K as Traders Eye Year-End Rebalancing Boost

Crypto Market at Major Inflection Point, Says Coutts

Based on an analysis of on-chain and market data, Coutts said he believes crypto is at a crossroads where substance may be about to overtake the hype.

“I believe we’re at a major inflection point,” Coutts said.

The market is obviously down, but when you look at the underlying data in the smart contract platform universe — essentially the digital economy —everything is looking rather good.

Jamie Coutts, Chief Crypto Analyst, Realvision

Jamie Coutts, Chief Crypto Analyst, Realvision Related: Bitwise’s Three Bold Crypto Calls That Could Redefine Bitcoin in 2026

Coutts explained that he sees crypto as having two parts — the cyclical part, mostly driven by on-chain trading, essentially degen stuff, and the structural part, which relates to metrics like stablecoin transfers and settlement volumes. He sees this structural part as likely to be where we see much of the growth over the next few years.

The structural demand from payments, collateral, AIs gonna start coming through in the next 18 months. I feel that the digital economy and the onboarding of traditional assets on-chain is going to change the cycle. I think this represents a pretty good opportunity if you’ve got a time horizon over the next 5 years.

Jamie Coutts, Chief Crypto Analyst, Realvision

Jamie Coutts, Chief Crypto Analyst, Realvision The post Bitcoin Bull Market Not Over, Says Realvision’s Jamie Coutts appeared first on Crypto News Australia.