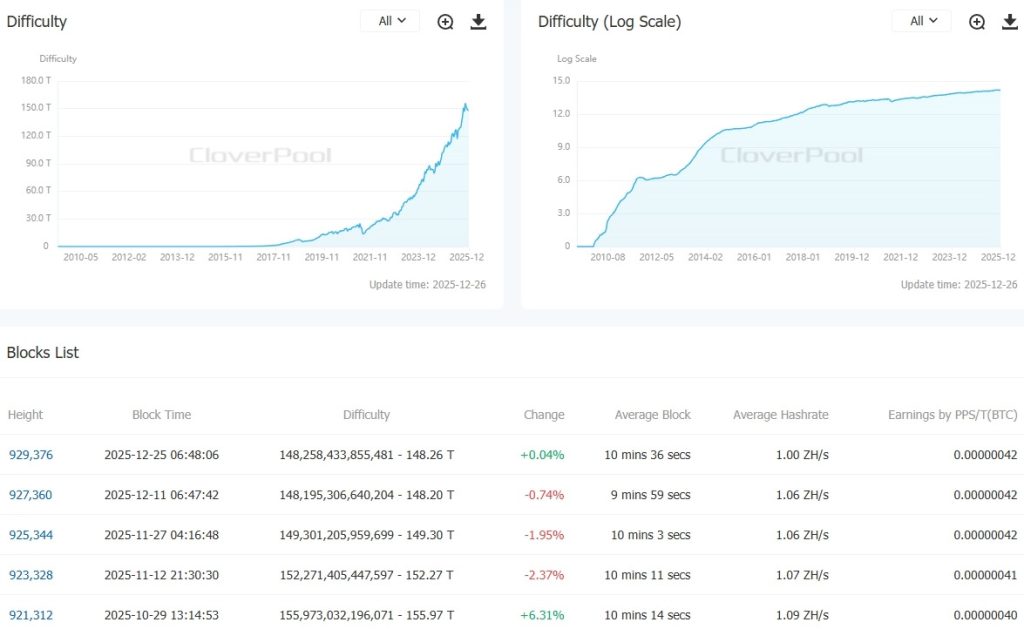

On December 25th, following the latest adjustment, the mining difficulty of the leading cryptocurrency increased by a modest 0.04% to 148.26 T.

After reaching an all-time high of 155.97 T on October 29th, the metric recorded three consecutive declines: 2.37%, 1.95%, and 0.74%.

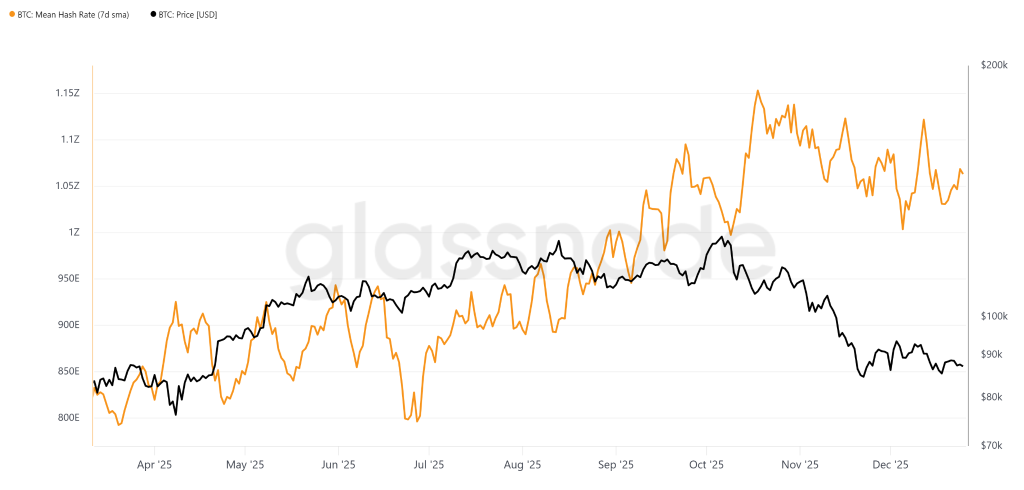

Meanwhile, Bitcoin’s hashrate remained above 1 ZH/s. According to Glassnode, the seven-day moving average is approximately 1.06 ZH/s.

The restrained growth in difficulty indicates that recent reductions in the network’s computational power have not significantly impacted miners’ activities, noted TheMinerMag. The mid-December hashrate drop was attributed by some observers to the closure of Bitcoin farms by Chinese authorities in the Xinjiang Uyghur Autonomous Region. Others pointed to a range of contributing factors, including cold weather in the United States.

The reduction in network power proved temporary, although VanEck analysts even spoke of miners capitulating, shutting down unprofitable equipment.

According to TheMinerMag, network difficulty has adjusted downwards by about 4% from its peak. During this period, digital gold prices have fallen by approximately 20%. Historically, such divergence typically leads to weaker players exiting the market.

“So far, such capitulation has not materialized. The limited decline in difficulty and stable hashrate indicate that the network is coping with economic stress without large-scale shutdowns,” industry publication experts emphasized.

The stabilization of blockchain technical parameters means that hashprice will remain around $38 per PH/s per day, continuing to pressure mining economics.

Earlier in December, institutional investors began buying bitcoins faster than miners could produce them.