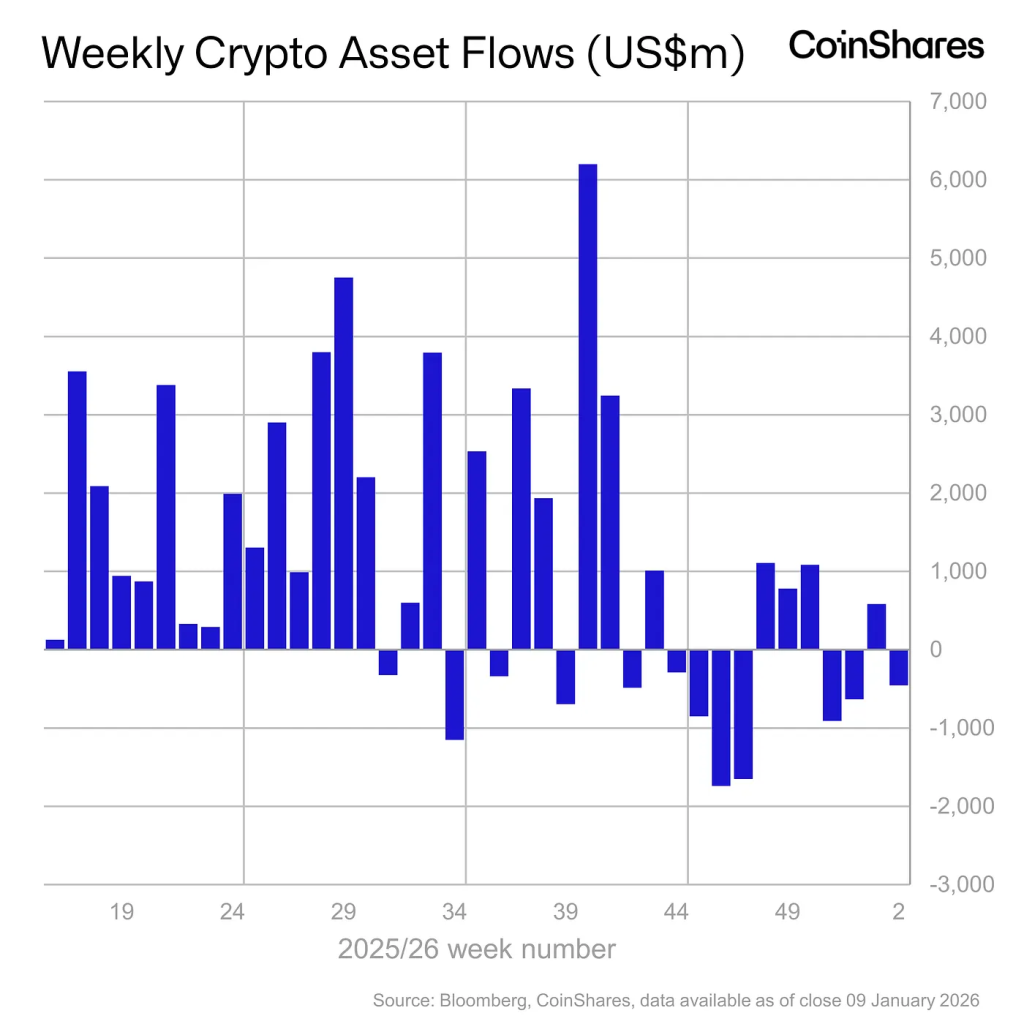

Between December 2 and 10, cryptocurrency investment products experienced an outflow of $454 million, according to a report by CoinShares.

Negative trends were observed for most of the week. The outflow reached $1.3 billion, nearly offsetting the $1.5 billion inflow seen in the early days of 2026.

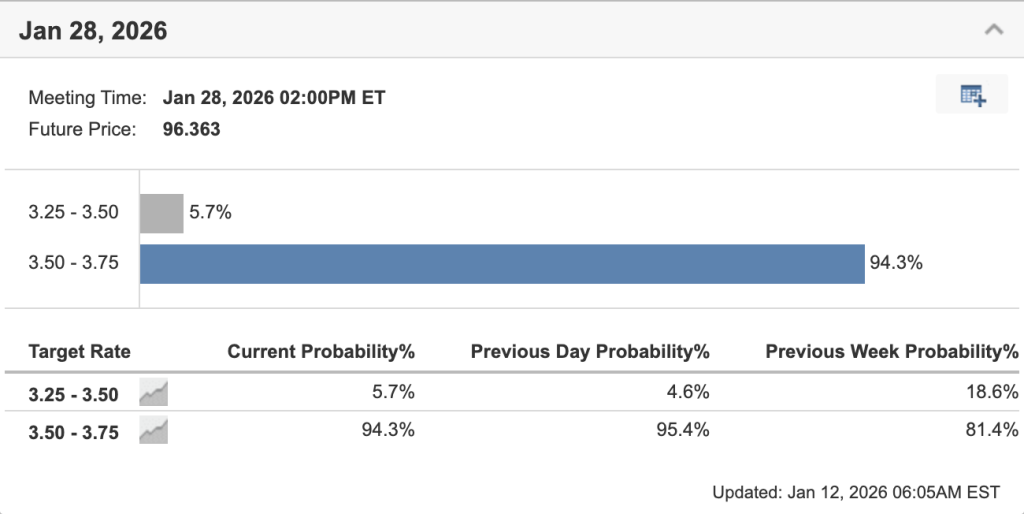

The shift in expectations regarding the actions of the Fed was the cause. The market is convinced that the regulator will refrain from lowering rates and will maintain the current levels.

The meeting is scheduled for January 28.

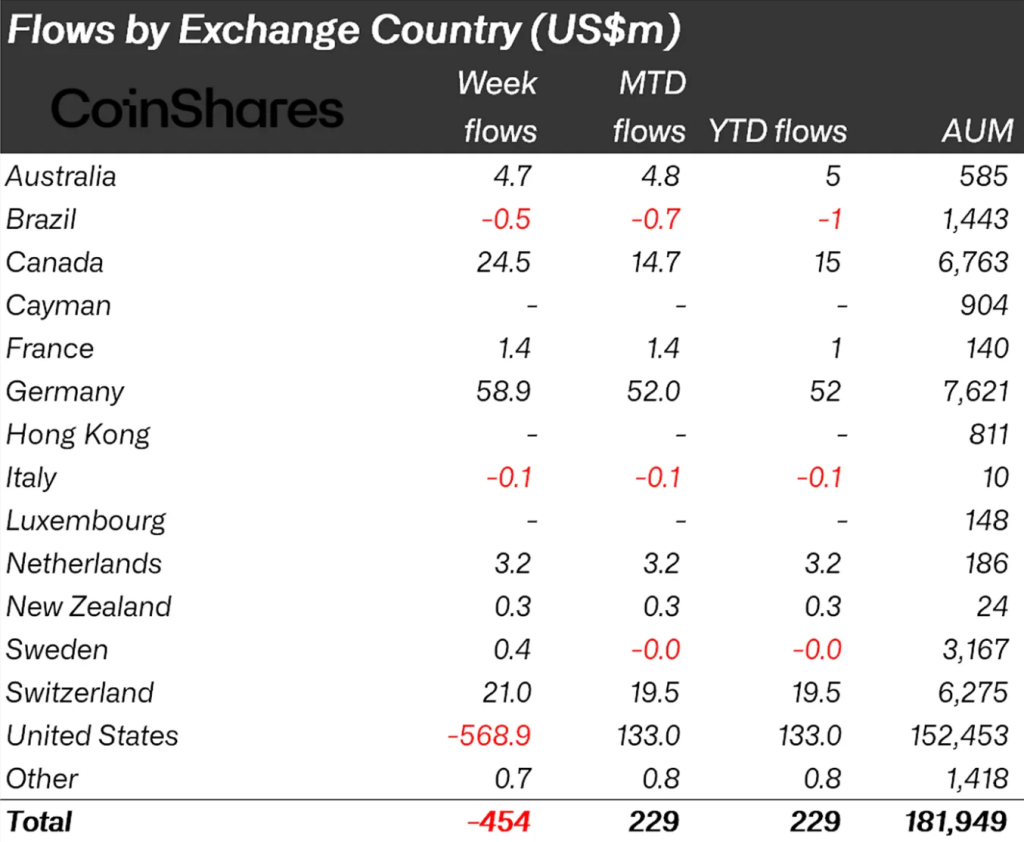

The main wave of sales occurred in the US, with an outflow of $569 million. Germany led with an inflow of $58.9 million. Canada and Switzerland accounted for $24.5 million and $21 million, respectively.

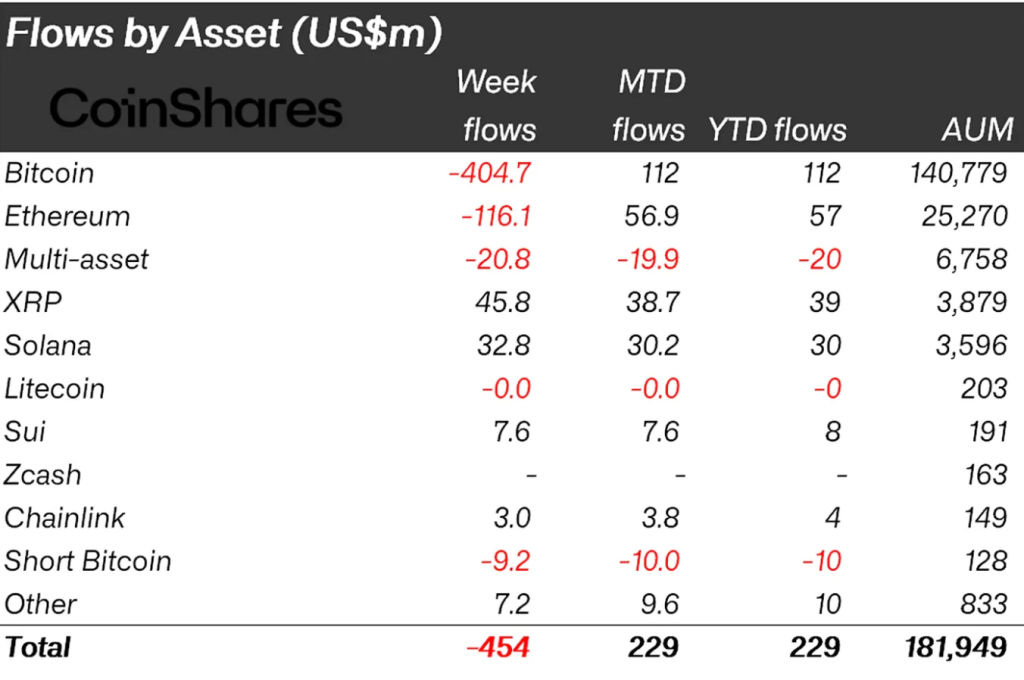

Bitcoin funds lost $405 million. Meanwhile, short structures based on the first cryptocurrency lost $9.2 million. According to experts, the situation sends mixed signals about the overall market sentiment towards digital gold.

Ethereum products saw an outflow of $116 million, while multi-ETP lost $20.8 million.

Funds based on XRP and Solana continue to attract capital. Last week, they received $45.8 million and $32.8 million, respectively.

At the end of 2025, the total inflow into cryptocurrency exchange-traded products amounted to $47.2 billion. This figure slightly lagged behind the record $48.7 billion recorded the previous year.