Amid widespread protests and a record decline of the Iranian rial, citizens have significantly increased the transfer of the leading cryptocurrency from exchanges to personal wallets, according to data from Chainalysis.

New analysis reveals Iran’s crypto ecosystem surpassed $7.78B in 2025, with on-chain activity closely correlated with geopolitical and domestic tensions.

Our data show:

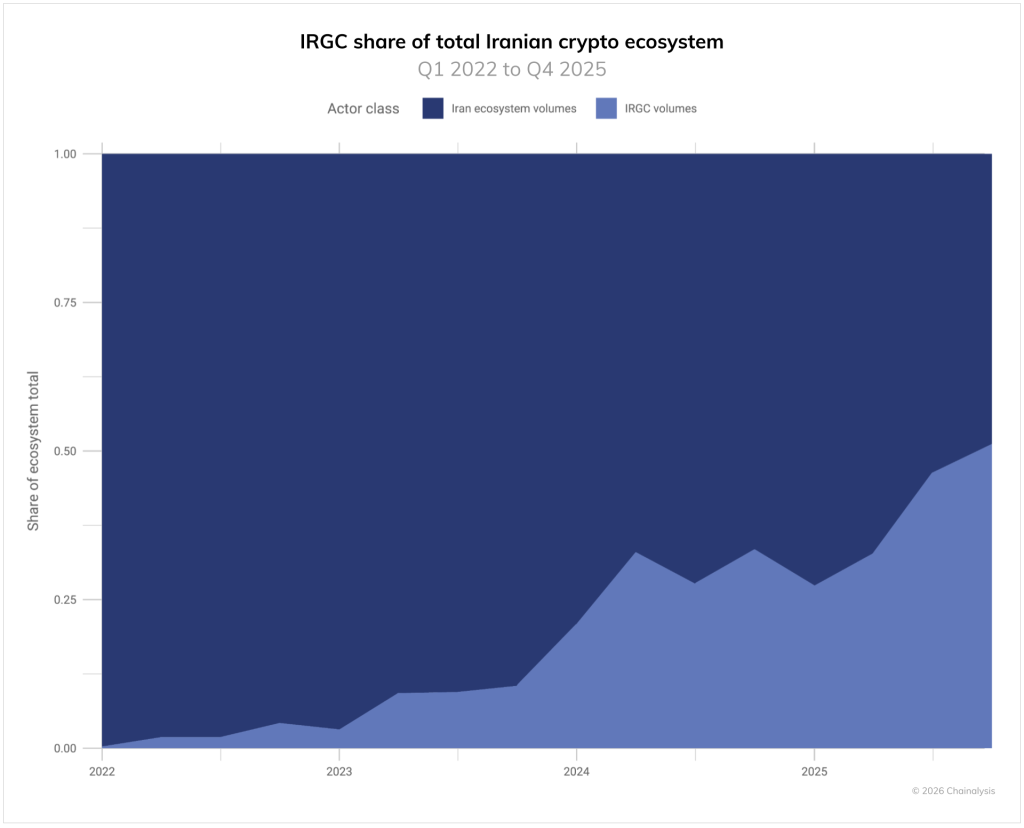

— IRGC-linked addresses now represent 50% of Iran’s crypto economy

— Iranians increasingly withdraw Bitcoin…— Chainalysis (@chainalysis) January 15, 2026

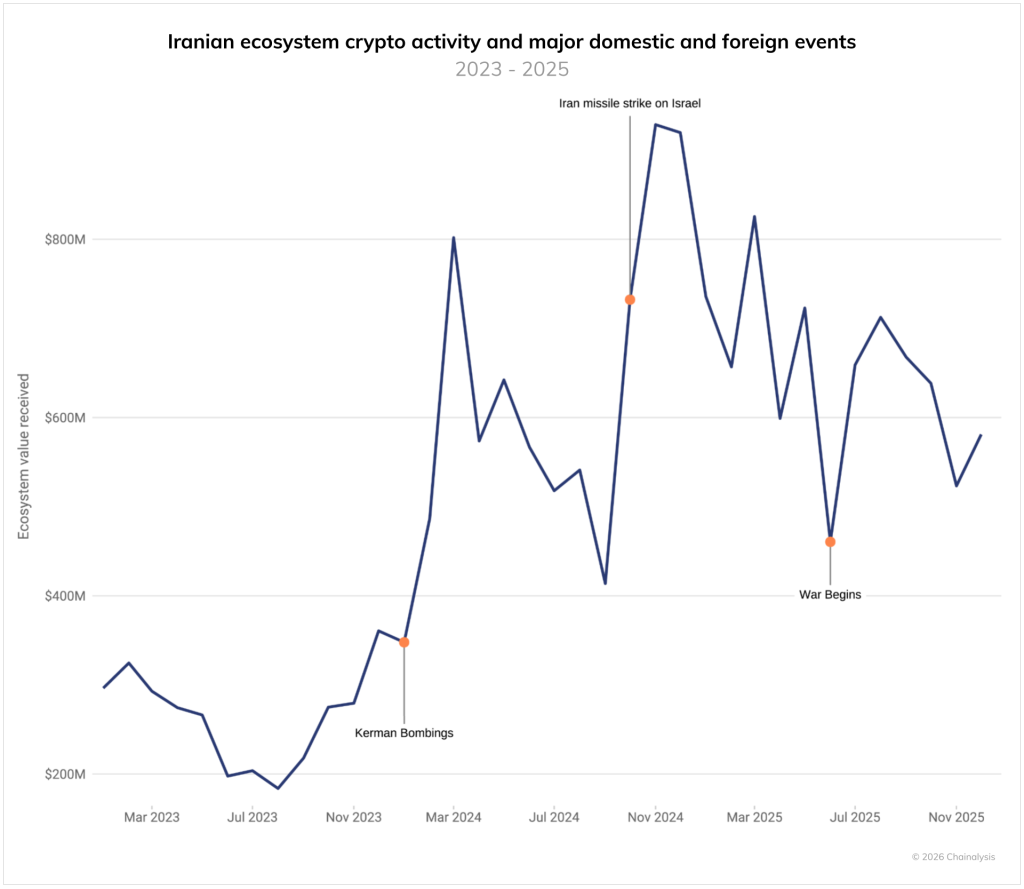

Analysts estimate that by the end of 2025, Iran’s crypto ecosystem was valued at $7.78 billion. Experts identified a clear correlation: spikes in activity coincide with periods of political crises and military actions, such as strikes on Israel or the 12-day war.

Chainalysis recorded a change in user behavior amid the mass unrest. From December 28 to January 8 (before the internet shutdown in the country), there was a sharp increase in:

- the average transaction volume in US dollars;

- the number of transfers to personal wallets.

“This indicates that Iranians began transferring Bitcoin into personal ownership during the protests much more frequently than before. Such behavior is a rational response to the collapse of the Iranian rial, which lost almost all its value and became practically worthless against major currencies,” researchers commented.

According to them, Bitcoin has become not just a savings tool but a means of financial resistance. Its censorship resistance and independence from the state system provide Iranians with critically important financial flexibility and control over their assets in times of crisis.

Analysts emphasized that the surge in withdrawals to personal wallets during periods of repression aligns with global trends typical for politically unstable countries.

Simultaneously, researchers noted the dominance of the IRGC in the country’s digital sector. The structure now controls more than half of all transactions. Turnover on its controlled wallets sharply increased from $2 billion in 2024 to $3 billion in 2025.

“Importantly, even these figures are a lower estimate, including only a limited number of addresses from the sanctioned lists of IRGC wallets compiled by the OFAC and the NBCTF,” experts added.

The estimate did not include possible shell companies and financial intermediaries whose connection to the IRGC has not yet been confirmed. Researchers believe the final sum will increase as new wallets affiliated with the structure are identified.

Back in late December, Bitwise CEO Hunter Horsley described Bitcoin as a salvation from economic collapse in Iran.