The volume of money laundering through cryptocurrencies surged from $10 billion to $82 billion between 2020 and 2025. Chinese-language networks (CMLN) dominate this figure with a 20% share, noted Chainalysis.

In the next preview chapter of our 2026 Crypto Crime Report, we examine how Chinese-language money laundering networks processed $16.1 billion in illicit crypto funds in 2025 (about $44 million per day across 1,799+ active wallets).

Read the full analysis here:… pic.twitter.com/0Jla3ce5X1

— Chainalysis (@chainalysis) January 27, 2026

“This significant growth reflects the expanded availability and liquidity of digital assets, as well as a fundamental shift in how and through whom this laundering activity occurs,” noted the analysts from the company.

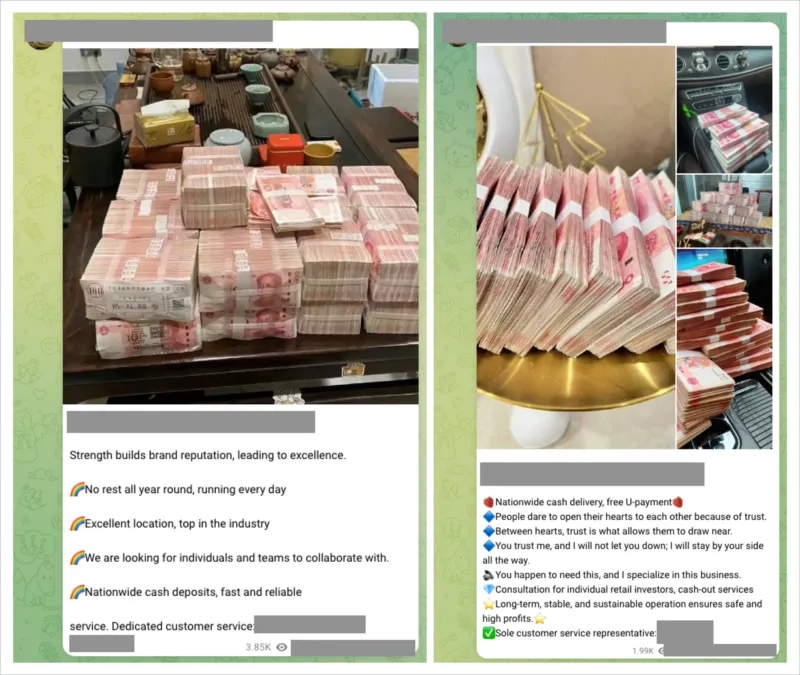

According to them, operating through Telegram and other messengers, CLMN have rapidly taken leading positions among other schemes for “whitening” illicit online revenues. The influx into these structures increased 7,325 times over five years compared to laundering volumes through centralized crypto exchanges and 1,810 times compared to DeFi protocols.

This is largely due to CLMN’s ability to scale quickly, experts believe. In 2025, Chinese-language platforms processed $16.1 billion through 1,799 active wallets — approximately $44 million per day.

CLMN is closely linked to international financial flows and the need to circumvent sanctions. Part of the liquidity comes through mechanisms for capital withdrawal from countries with strict control regulations, including China.

Infrastructure for Laundering

Chainalysis analysts described CLMN as integrated ecosystems comprising multiple links that ensure transaction fragmentation, exchange functions, distribution, and integration of funds into legal channels.

The main component of the networks is Guarantee-platforms like Huione and Xinbi. They provide marketplace services, offering participants in the segment the necessary infrastructure for asset escrow and trust mechanisms. These services do not directly participate in money laundering, allowing them to maintain the appearance of legitimate operations and openly promote themselves.

Chainalysis identified six main types of CLMN:

- “launch point” brokers — typically rent bank accounts and wallets from individuals to organize asset flows to exchanges;

- “money mule” networks — conceal the origin of funds by moving them through a network of accounts, including cross-border transfers;

- shadow OTC services — exchange assets without verifying origin and client verification;

- Black U platforms — purchase knowingly illegal cryptocurrency at a discount;

- gambling providers — legalize funds through gambling;

- mixers — operate similarly to well-known protocols like Tornado Cash or Blender.

Back in 2025, Chainalysis analysts estimated the total turnover of illegal crypto assets at $154 billion. This figure increased by 162% compared to the previous period.