Experts from Coinbase Institutional and Glassnode have noted a market recovery following the October deleveraging. This is detailed in a joint report by the companies.

According to analysts, the industry has become more resilient and “disciplined.” A key trend is the shift from aggressive risk-taking to defensive strategies.

Bitcoin’s Dominance and Investor Caution

The leading cryptocurrency maintained its dominance, with the index hovering around 59%. Mid and small-cap assets have lost upward momentum.

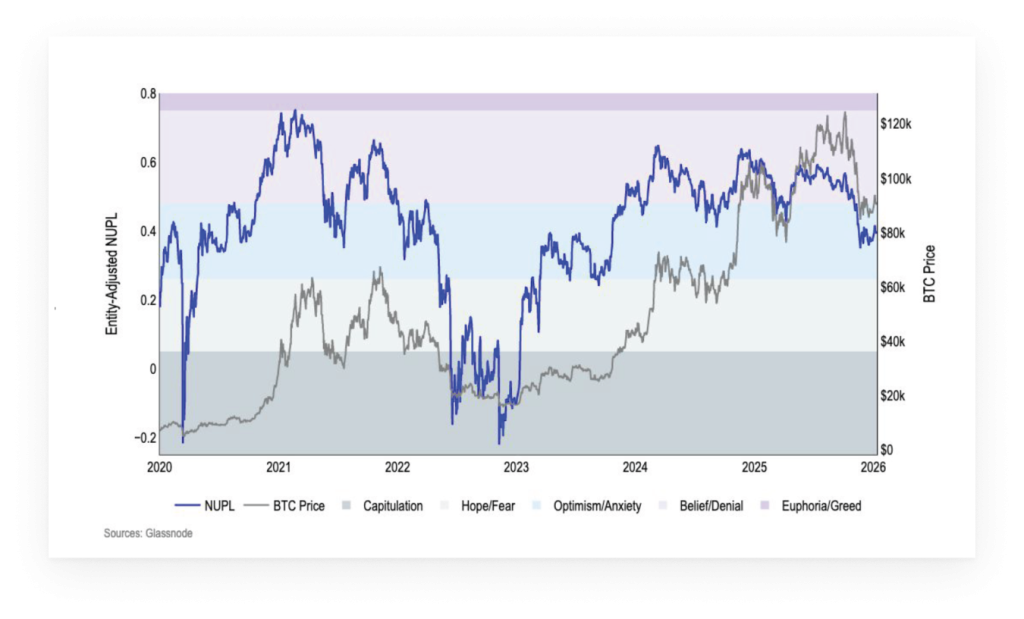

Market participants remain cautious. The Net Unrealized Profit/Loss (NUPL) indicator fell from the “Belief” zone to the “Anxiety” zone after the October liquidations.

The stabilization of this metric at low levels indicates investors’ reluctance to take directional risks, despite improved macroeconomic conditions.

The report also highlights an increase in coin distribution. In the fourth quarter, the share of Bitcoin’s active supply (coins moved in the last three months) rose to 37%.

Risk Aversion

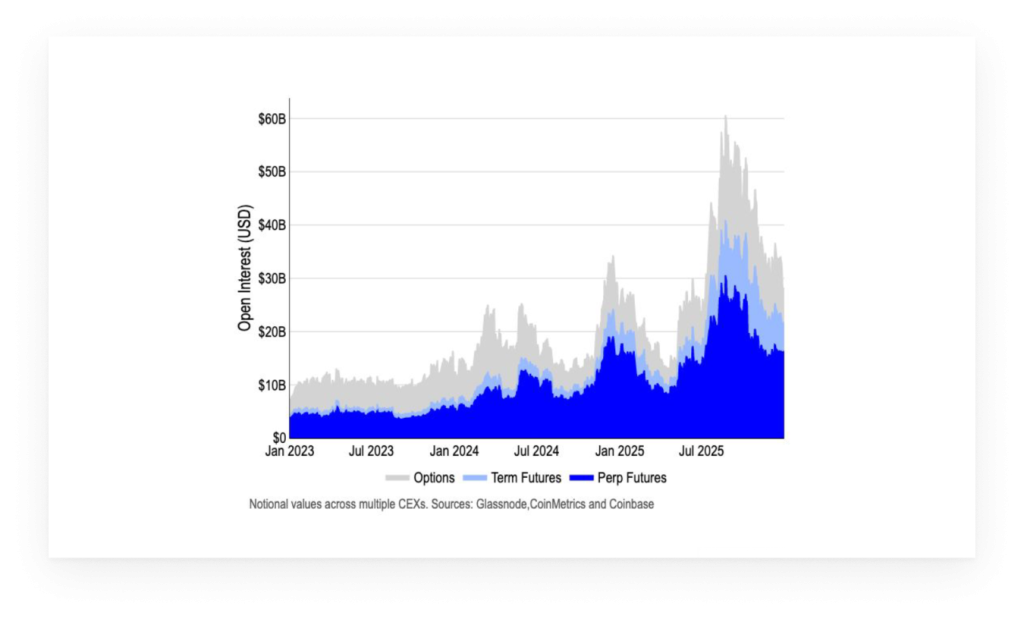

October’s events led to a significant reduction in systemic leverage. The volume of positions in perpetual futures decreased, and the leverage ratio (excluding stablecoins) fell to about 3% of the total market capitalization.

Instead of fully exiting assets, traders reallocated capital to the options market. Open interest in this sector surpassed that of Bitcoin perpetual futures. Market participants prefer instruments with fixed risk, making the trading environment more reliable.

Paradigm Shift for Ethereum

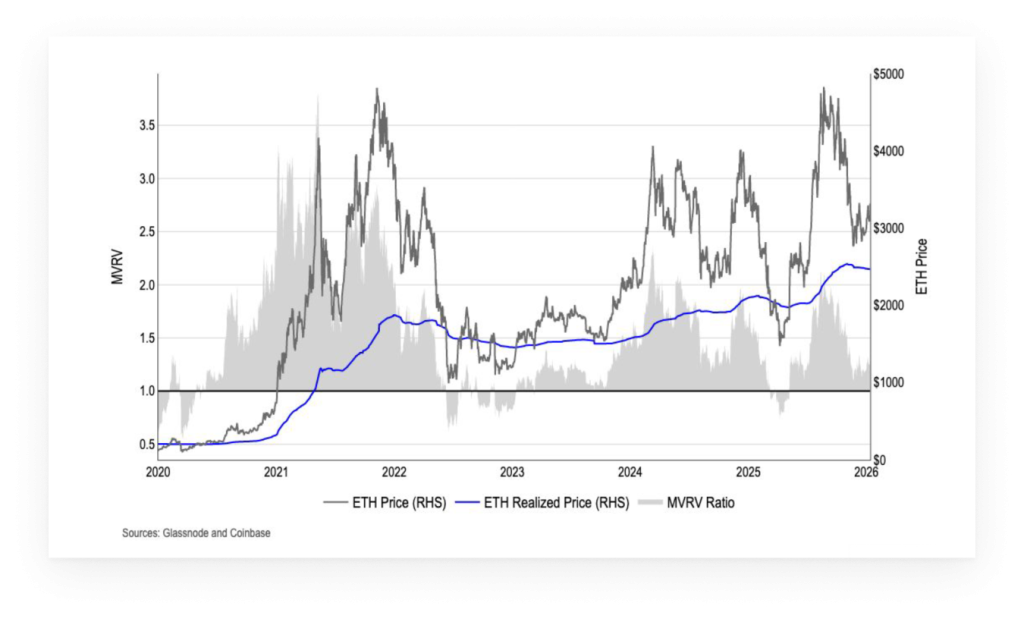

Analysts suggested that Ethereum is approaching the late stage of its current cycle, which began in June 2022. However, traditional cyclical indicators are losing their predictive power.

The cause is structural changes in the ecosystem, including fee compression in L2 networks and new tokenomics. Experts believe that Ether’s dynamics now depend more on overall liquidity conditions than on the market cycle’s duration.

Institutional investors, according to surveys, maintain “selective optimism” and continue to favor large-cap assets amid geopolitical uncertainty.

Earlier, analyst CryptoQuant Gaah reported that the realized loss of digital gold holders reached $4.5 billion, the highest in three years.