The world’s largest family offices have turned their attention to artificial intelligence, leaving cryptocurrencies overlooked, according to a report by JPMorgan.

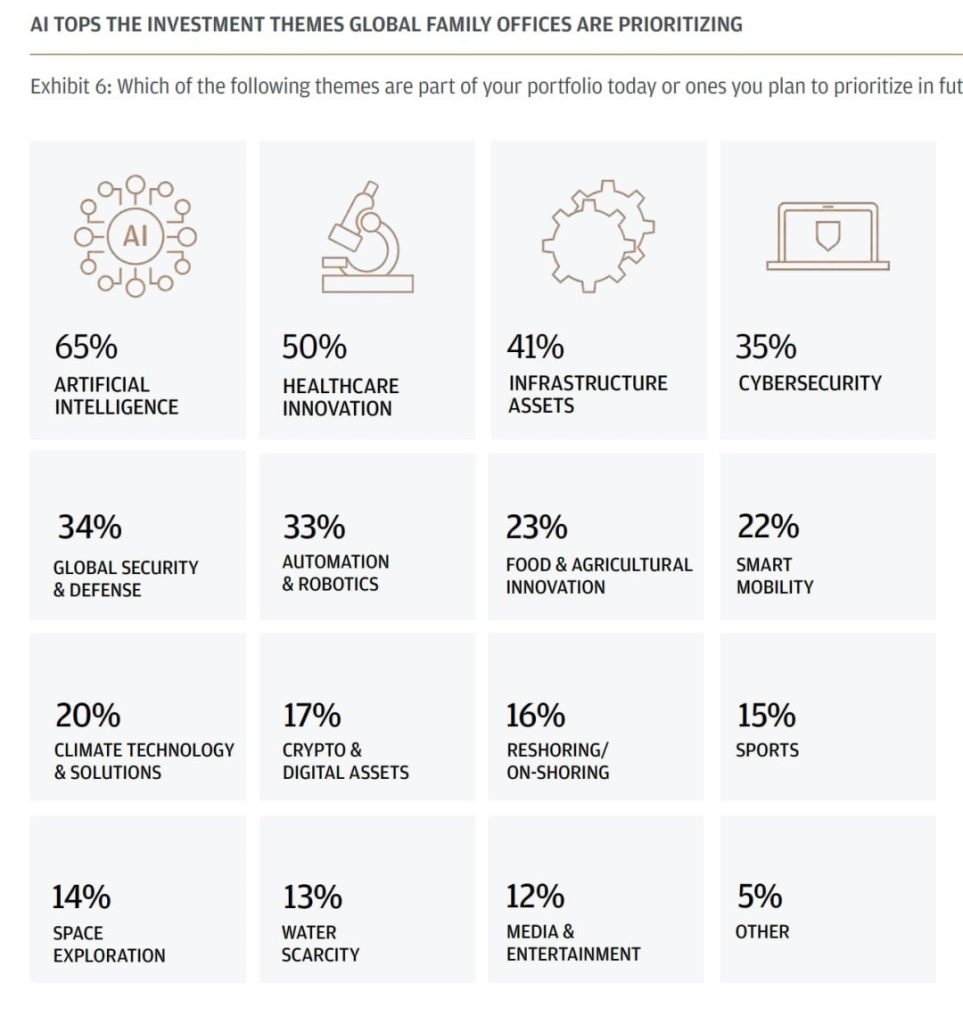

The bank surveyed 333 management companies from 30 countries. Sixty-five percent of respondents view AI technologies as a priority investment area. Only 17% (56 offices) consider digital assets a key topic.

Cryptocurrencies are virtually absent in the actual portfolios of family offices. Eighty-nine percent of survey participants have no exposure to this asset class. The average share of digital currencies in global capital allocation is a mere 0.4%, with Bitcoin accounting for 0.2%.

Investors are also ignoring gold. Seventy-two percent of respondents reported zero investments in the precious metal. Bank analysts noted a low appetite for safe-haven assets, despite geopolitical concerns.

Private equity emerged as the leader in planned investments. Thirty-seven percent of offices intend to increase their share in this sector over the next 12-18 months. Interest is growing in venture financing and growth equity investments, seen as a way to enter early stages of AI projects.

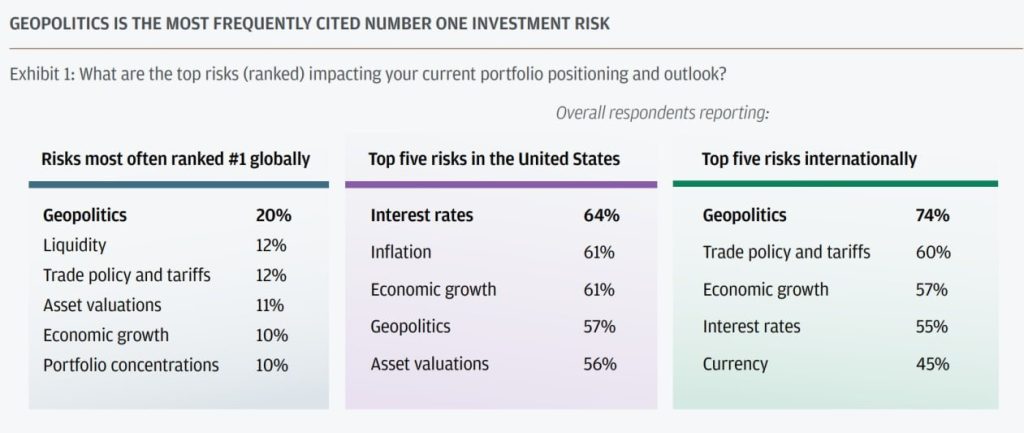

Geopolitics was identified as the main risk for portfolios by 20% of respondents. Liquidity issues and trade policy followed, each cited by 12%.

Earlier in January, JPMorgan experts forecasted an influx of major players into the crypto industry.