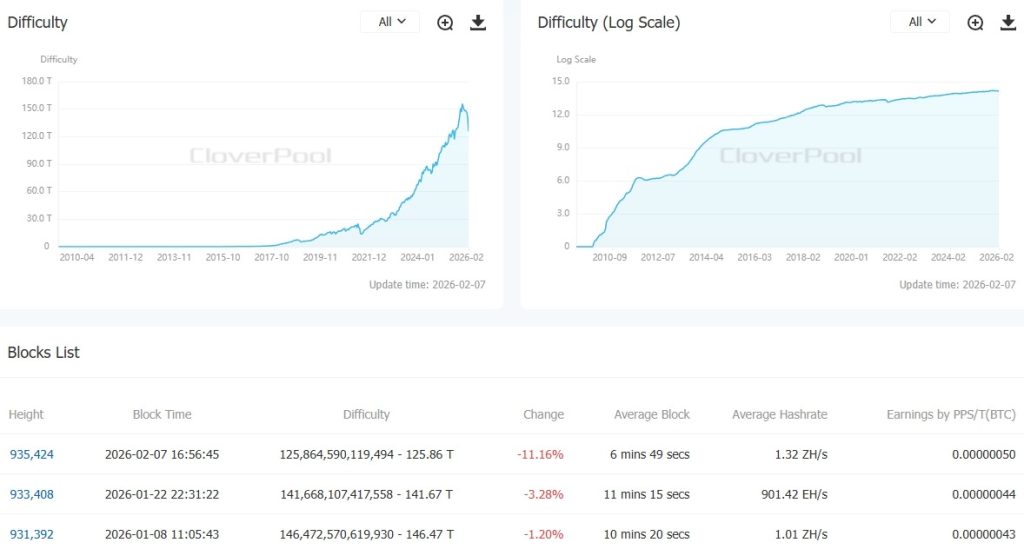

Following the latest adjustment, the mining difficulty of the leading cryptocurrency decreased by 11.16% to 125.86 T.

This decline is the most significant since the major crackdown on cryptocurrency miners in China in 2021, when the parameter plummeted by nearly 30% in early July.

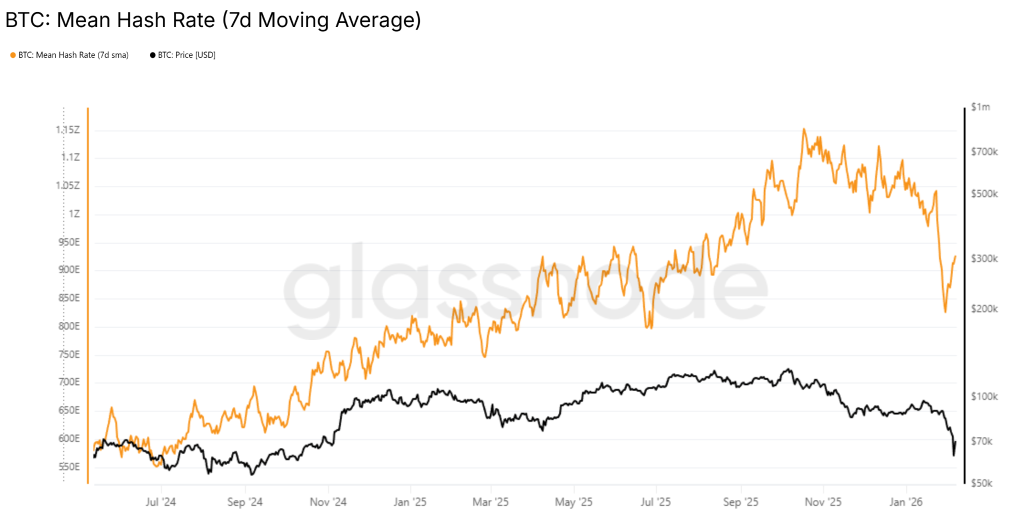

After the difficulty adjustment, Bitcoin’s hash rate surged to 1.3 EH/s, and the average interval shortened to approximately seven minutes. This was likely due to the return of capacities that were massively shut down amid worsening mining economics and the aftermath of the winter storm in the United States.

According to Glassnode, on January 30, the hash rate smoothed by a seven-day moving average reached a local minimum of 826 EH/s. It then rose to 927 EH/s.

Data from Hashrate Index shows that over the past 24 hours, the hash price increased from approximately $31.5 per PH/s per day to $34.8.

The primary profitability metric has risen significantly above the “hash price” for the most efficient public miners like CleanSpark ($30 per PH/s per day) and IREN ($26). However, companies in the sector remain on the brink of break-even, noted TheMinerMag.

Back in 2025, mining difficulty had already decreased twice — first by 1.2%, and then by another 3.28%.