Uniswap Labs and the RWA platform Securitize have entered into an agreement to list the tokenized BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on the UniswapX liquidity aggregation protocol.

“The integration will enable trading of BUIDL on the blockchain, opening new liquidity opportunities for holders and marking an important step in bridging the gap between traditional finance and DeFi,” the press release states.

As part of the deal, BlackRock also announced strategic investments in Uniswap and acquired an undisclosed amount of the native UNI token.

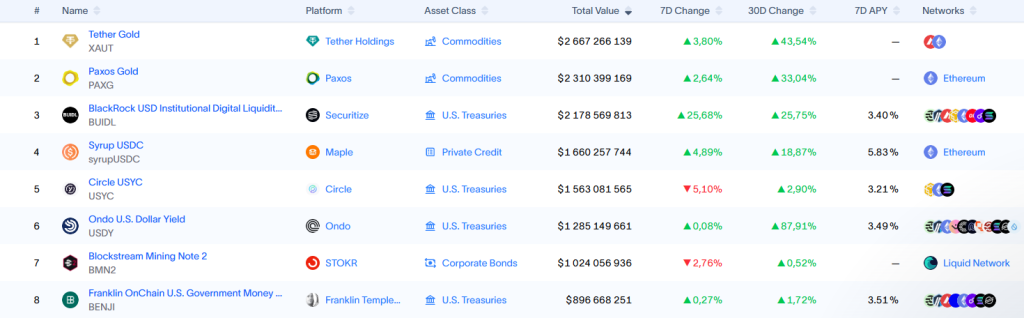

Launched in 2024, BUIDL is the largest tokenized US Treasury bond fund on the market, with a total locked value of $2.1 billion, according to RWA.xyz.

The appearance of BUILD on the Uniswap platform provides investors with round-the-clock on-chain access to the instrument. Trading of the fund is available in both directions.

“The integration of BUIDL into UniswapX marks a significant step forward in ensuring compatibility of stablecoins with tokenized funds yielding returns in US dollars,” noted Robert Mitchnick, head of BlackRock’s digital assets division.

Following the news, the UNI token surged by 14% in a day. The asset’s price rose from approximately $3.2 to $3.8, briefly surpassing the $4 mark.

In November 2025, support for the BNB Chain was added for BUILD. Initially launched on Ethereum, the fund also operates on first-layer networks such as Aptos, Avalanche, Solana, and L2 solutions like Arbitrum, Polygon, and Optimism.