A closely watched gauge of digital-gold mining profitability has sunk to a record low. Large mining firms are unplugging machines amid a price slump in the first cryptocurrency and rising electricity tariffs.

A closely watched measure of Bitcoin mining revenue has dropped to the lowest on record with more of the large-scale computing outfits that make the cryptocurrency work unplugging equipment while prices tumble and energy costs climb https://t.co/RumS7SR9JH

— Bloomberg (@business) February 5, 2026

Revenue per unit of compute has fallen to 3 cents per terahash. For comparison, in 2017 it stood at $3.5.

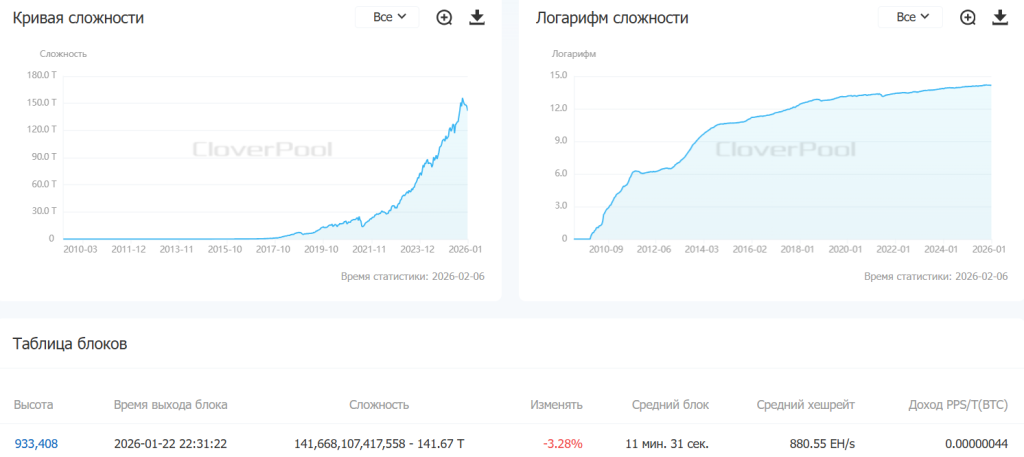

Mining difficulty stands at 141.66 T.

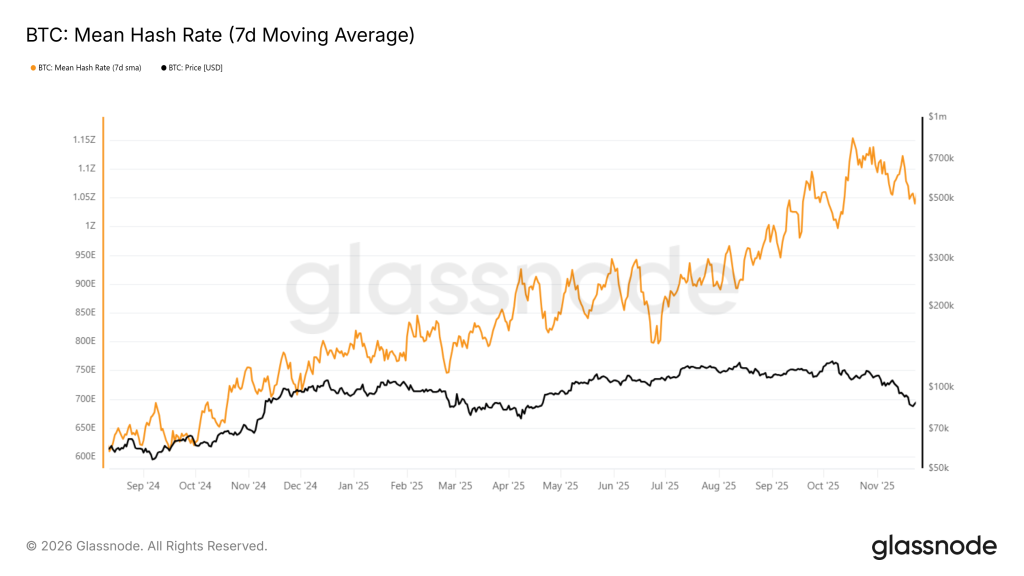

According to Glassnode, hashrate (7DMA) is above 1 ZH/s.

Newhedge analysts forecast a drop in mining difficulty of more than 13% at the next adjustment. That would be the biggest fall since China’s ban on the crypto industry in 2021.

The rout hit listed miners. On February 5, CleanSpark fell 10%, MARA 11%, TeraWulf 8.5% and Riot 4.8%.

CleanSpark executive Harry Sudok called the downturn historic and highlighted two causes:

- Bitcoin’s price plunge.

- Winter storms in the United States.

In late January, bad weather in Texas and Tennessee sent electricity prices spiking. Miners shut down rigs because operations became unprofitable or under grid-balancing programmes.

To diversify revenue, CleanSpark and TeraWulf have begun refitting data centres for AI. Even so, bitcoin mining still provides most of their takings.

Whale moves

According to Arkham, MARA moved 1,317 BTC (~$87.4 million) to external wallets and exchanges.

The largest tranche, 653.7 BTC ($43.4 million), went to an address linked to digital-asset manager Two Prime. It later sent another 9 BTC there.

Roughly 300 BTC went to custodian BitGo, with the remaining 355 BTC dispersed to unidentified wallets.

IREN

Shares in the largest public miner, IREN, fell 11.5% in the main session and lost a further 13% after-hours.

Key figures from the quarterly report:

- Revenue: down to $184.7 million (forecast — $224 million).

- Net loss: $155.4 million (profit of $384.6 million in the previous quarter).

The loss mainly reflects a $219 million revaluation of financial instruments and $31.8 million of equipment impairment, tied to the planned shift of British Columbia data centres from mining to AI compute.

Co-founder Daniel Roberts noted strong demand for data-centre services. The company is reallocating capacity toward more lucrative AI workloads.

CleanSpark

CleanSpark’s shares fell nearly 20% during trading and slid another 10% after the close.

Financial results:

- Revenue: $181.2 million, $13 million below consensus.

- Net loss: $378.7 million (a profit of $246.8 million a year earlier).

Working capital as of December 31, 2025 was $1.3 billion.

President Gary Vekkiarelli said the business model is being transformed. The company now diversifies income: mining generates current cash flow, while AI infrastructure is aimed at the long term.

In November 2025, Bitfarms announced a gradual exit from the industry and a pivot to AI infrastructure.

In January this year, Bit Digital flagged similar plans. The company intends to cease mining entirely to focus on AI strategies and investments in Ethereum.