On January 29, the leading cryptocurrency sharply fell from $88,000 to $85,000, losing approximately 3.5%. The drop followed a decline in gold prices.

Shortly before the correction, the precious metal reached another all-time high of $5,600 per ounce. At the time of writing, it is trading around $5,100.

The stock market also recorded a decline: the S&P 500 index fell by 1.36% over the day, and the NASDAQ by 1.8%.

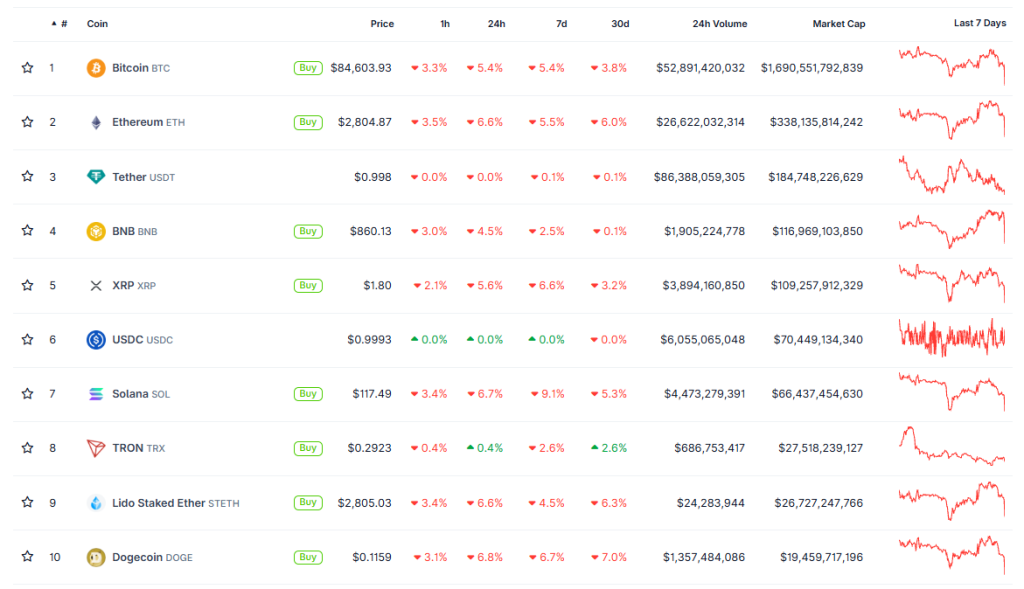

Following Bitcoin, gold, and stocks, the rest of the crypto market also turned red. All top-10 cryptocurrencies by market capitalization showed a decline.

Ethereum fell to $2,800, and Solana dropped below $120.

The total cryptocurrency market capitalization fell below $3 trillion for the first time since April 2025.

Expert Observations

Analyst Michaël van de Poppe noted that Bitcoin’s current valuation relative to gold has dropped to 2016 lows.

I would be incredibly happy if I were taken back to 2015, to be buying #Bitcoin at the peak bottom then.

The current valuation of Bitcoin vs. Gold is lower than the bottom of that cycle.

Back then, $BTC crashed to $160.

After that period, a 100X happened.

The data tells the… pic.twitter.com/WvM6qX3qHn

— Michaël van de Poppe (@CryptoMichNL) January 29, 2026

“Back then, the first cryptocurrency crashed to $160. After that, a hundredfold increase occurred. The data speaks for itself: Bitcoin is currently significantly undervalued,” he added.

The trader known as DaanCrypto highlighted the acceleration of the global liquidity index at the beginning of 2025. According to him, “significant movements” occurred in all asset classes except Bitcoin.

According to Glassnode, the realized profit and loss ratio (90DMA) fell from peak values around 19 in July 2025 to just 1.7 currently.

Chart of The Week: Realized Profit/Loss Ratio

The 90D-SMA Realized Profit/Loss Ratio has plummeted from a peak of 19 in July 2025 to just 1.7 today. This sharp decline signals a major shift in market demand and rising investor frustration.

Are we repeating the low-liquidity… https://t.co/hI66GUNekV

— glassnode (@glassnode) January 29, 2026

This sharp decline indicates a significant change in market demand and growing investor dissatisfaction, researchers explained.

Glassnode identified the $83,400 level as the last support before Bitcoin’s price collapse.