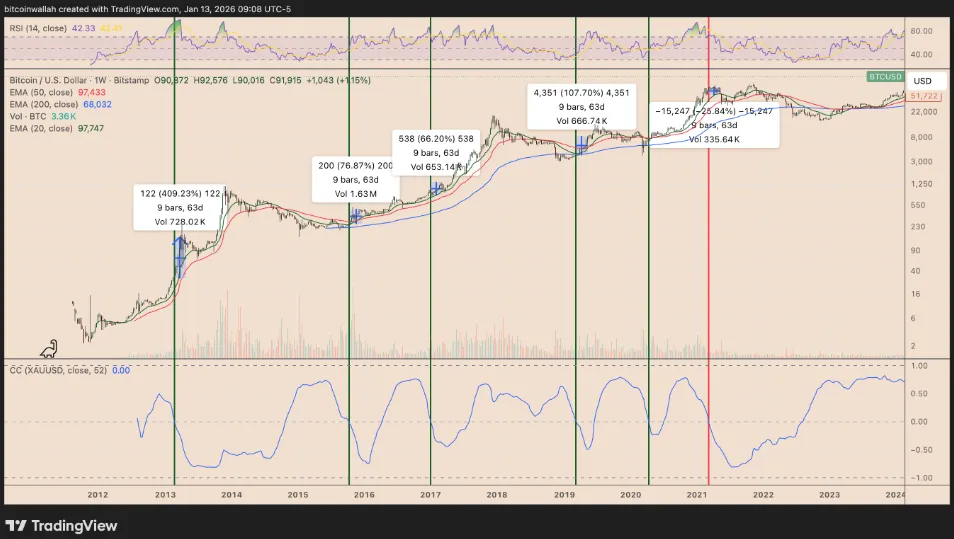

For the first time since mid-2022, the 52-week correlation between Bitcoin and gold has fallen to zero. By the end of January, the indicator might enter negative territory, according to Cointelegraph analyst Yashu Gola.

Historically, a decoupling of these assets has preceded rallies in the leading cryptocurrency. In four similar instances, Bitcoin’s price increased by an average of 56% within two months after the signal.

The only exception was in May 2021, when prices fell by 26% amid China’s mining ban and Tesla’s refusal to accept digital assets.

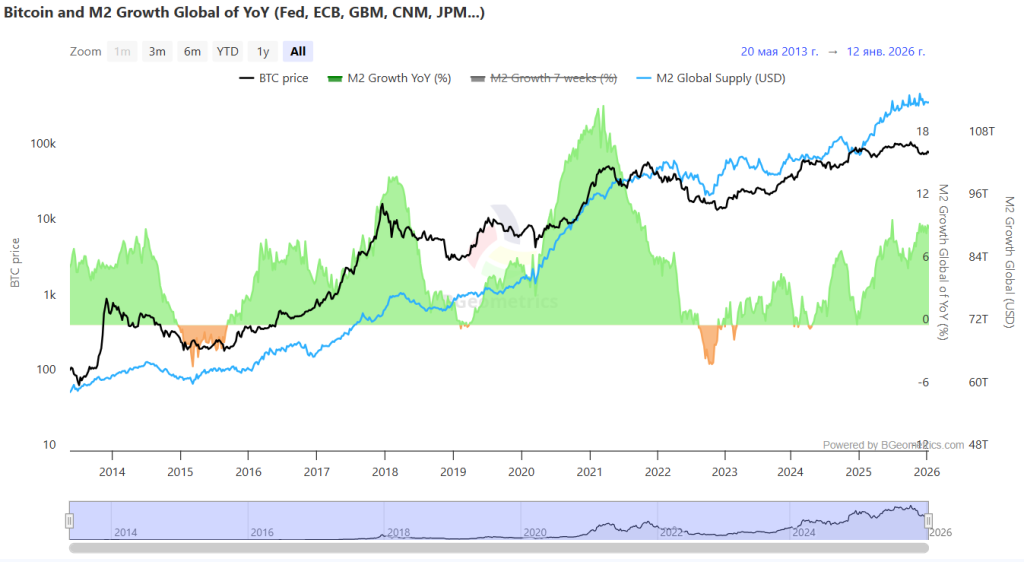

Current macroeconomic conditions are conducive to growth. Global liquidity (M2 aggregate) is increasing, and the US Federal Reserve is winding down its quantitative tightening policy.

Matt Hougan, Head of Research at Bitwise, stated:

“Bitcoin bull markets coincide with periods of rising global liquidity. The new cycle of policy easing will be a price catalyst through 2026.”

In 2025, gold rose by 65%, while the leading cryptocurrency showed weak performance. However, Hougan believes the coin will reclaim its leadership in 2026.

He added that the low long-term correlation of assets allows Bitcoin to enhance portfolio returns without the risks of “gold leverage.”

Analyst Tuur Demeester confirmed that accelerated “money printing” remains the main market driver.

Bitcoin performance vs change in global M2. While gold & silver have been absorbing demand for inflation hedges, accelerated money printing remains a major tailwind for bitcoin. HT @DigitalAssets

From the report: “Historically, bitcoin bull markets have aligned with periods of… pic.twitter.com/83IEm8g6VN

— Tuur Demeester (@TuurDemeester) January 12, 2026

A trader under the pseudonym Midas noted the similarity of the current chart with the 2020-2021 cycle. The price is now emerging from the accumulation phase, as it did before the parabolic rise to $70,000.

This setup looks similar to 2020–2021

If it repeats, $BTC could reach $150k

BULL RUN IS COMING pic.twitter.com/rBQXSqbo5X

— Midas (@DeFiMidas) January 9, 2026

In his view, a repeat of the scenario and realization of the 56% growth potential could push Bitcoin into the $150,000 range.

Market Reset

Since early October, the open interest (OI) volume in Bitcoin futures on Binance has fallen by more than 31%. CryptoQuant analyst Darkfost described this as a sign of market recovery and leverage reduction.

Deleveraging signal as BTC OI drops by 31%

“Historically, they have often marked significant bottoms, effectively resetting the market and creating a stronger base for a potential bullish recovery.” – By @Darkfost_Coc pic.twitter.com/JkYoKfg4Ql

— CryptoQuant.com (@cryptoquant_com) January 14, 2026

On October 6, the indicator reached a historic high, exceeding $15 billion. For comparison, at the peak of the bull phase in November 2021, the volume of open positions was only $5.7 billion. In 2025, traders’ interest in derivatives nearly tripled.

Following the record, a correction to $10 billion ensued—below the 180-day moving average. The decline was accompanied by a wave of liquidations.

According to the analyst, the current deleveraging phase will “revitalize the market”:

“Historically, such periods have often indicated the formation of a bottom, effectively ‘resetting’ the market and creating a foundation for future recovery.”

Darkfost warned that a growth scenario is not guaranteed. If Bitcoin’s price continues to fall, open interest will decrease even further. This could signal a deeper correction and a full transition into a bearish phase.

Analysts have suggested that digital gold could surpass the psychologically significant $100,000 level by the end of January.