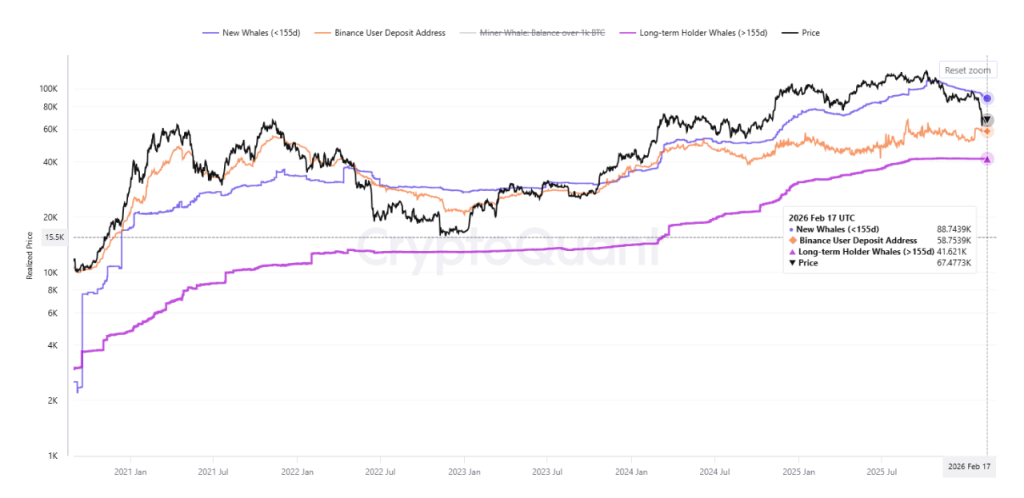

To determine the long-term trend, attention should be paid to four key levels of realised price for Bitcoin investors. This was stated by CryptoQuant analyst Burak Kesmechi.

According to the expert, crossing these levels would indicate a potential movement of the asset towards a deeper bottom. He referred to this as a “roadmap.”

Kesmechi identified the following levels:

- overall realised price (RP) of BTC — $54,700;

- RP of long-term whales — $41,600;

- RP of new whales – $88,700;

- RP of Binance user deposit addresses — $58,700.

“Bitcoin has been falling since it dropped below the entry point of new whales — a classic bear cycle signal. Next, I will watch two key support levels — [the first and fourth from the list],” added the analyst.

The CryptoQuant researcher noted that after the first cryptocurrency falls below the “newcomers'” basis, its price historically tests the realised price. The only support level in such a case remains at $58,700.

“The question is whether these two critical values will hold as support? Or will we feel the deeper, bone-chilling waters?” concluded Kesmechi.

Earlier, another CryptoQuant analyst, Ignacio Moreno de Vicente, noted that the short-term Sharpe ratio for Bitcoin has dropped to a level that historically preceded price lows.