Bitdeer, the mining company led by Jihan Wu, announced in its weekly report the sale of all mined and held coins—approximately 943.1 BTC (around $64 million at the time of writing).

Bitdeer #BTC Weekly Update

🔹 BTC Holdings: 0 (pure holdings, excluding customer deposits)

🔹 BTC Output: 189.8 BTC

🔹 BTC Sold: 189.8 BTC

🔹 Net BTC Added: -943.1 BTC

📅 Data as of February 20, 2026.#Bitcoin #BTC #BitcoinHoldings #BitcoinCommunity #BTCMining $BTDR pic.twitter.com/vtvBVEui0Q— Bitdeer (@BitdeerOfficial) February 21, 2026

Of this amount, 189.9 BTC was mined by the firm over the past week.

As of February 20, the company had no bitcoins left on its balance sheet, except for customer deposits.

In recent weeks, Bitdeer has been actively selling the leading cryptocurrency, albeit in much smaller volumes. Typically, the miner only sold the coins it had mined.

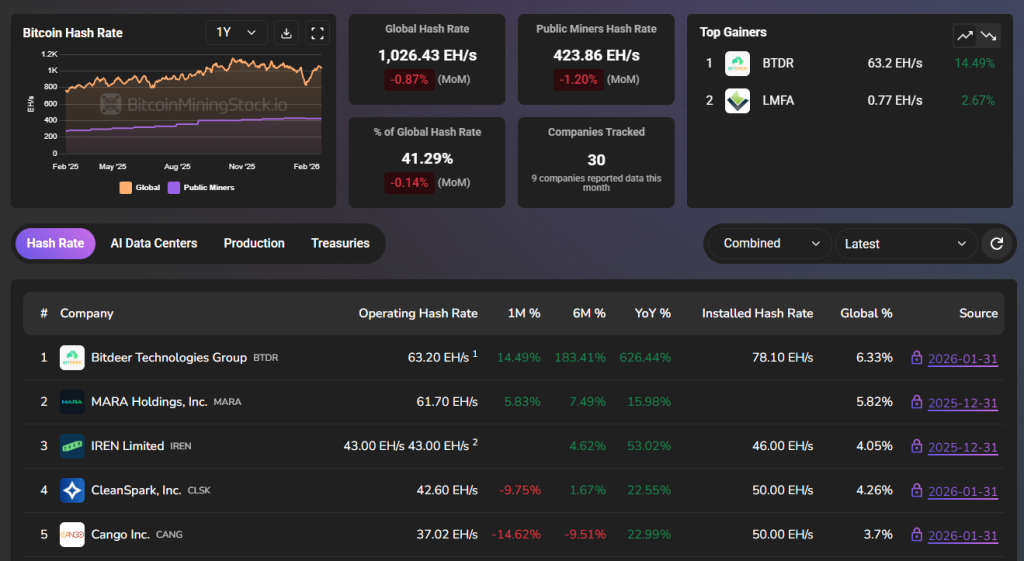

According to the January report, the company’s own hash rate reached 63.2 EH/s, a 14% increase from December. Last month, it mined 668 BTC.

Data from BitcoinMiningStock shows that Bitdeer has surpassed the previous leader, MARA Holdings, which currently has a capacity of 61.7 EH/s. Thus, Jihan Wu’s firm has become the largest public miner by hash rate.

Meanwhile, the company’s shares are not faring well. Over the past month, BTRD’s stock price has dropped by 46%.

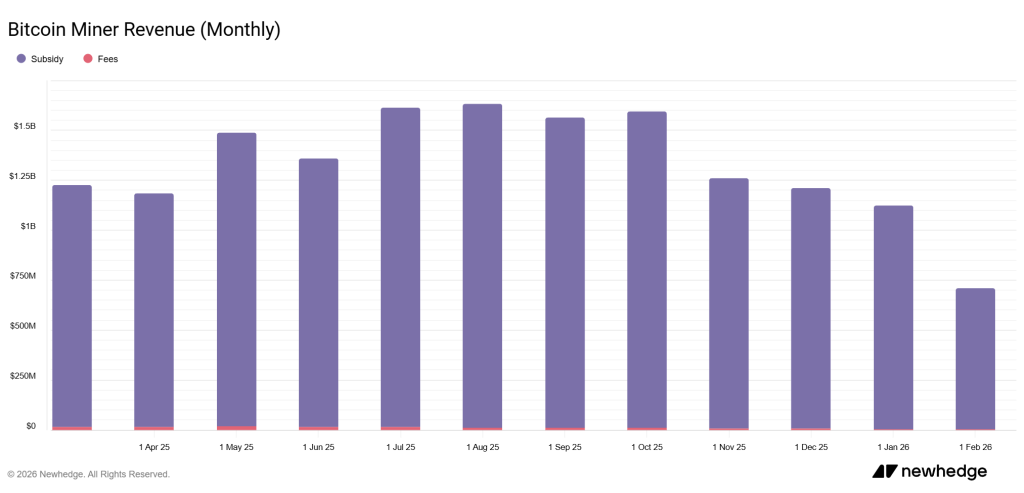

Challenging Times

Miner revenues have significantly decreased since October 2025. At that time, the figure was $1.59 billion, but by January it had fallen to $1.12 billion.

Under these conditions, miners are compelled to sell mined assets to sustain operations, sometimes even depleting reserves, as seen with Bitdeer.

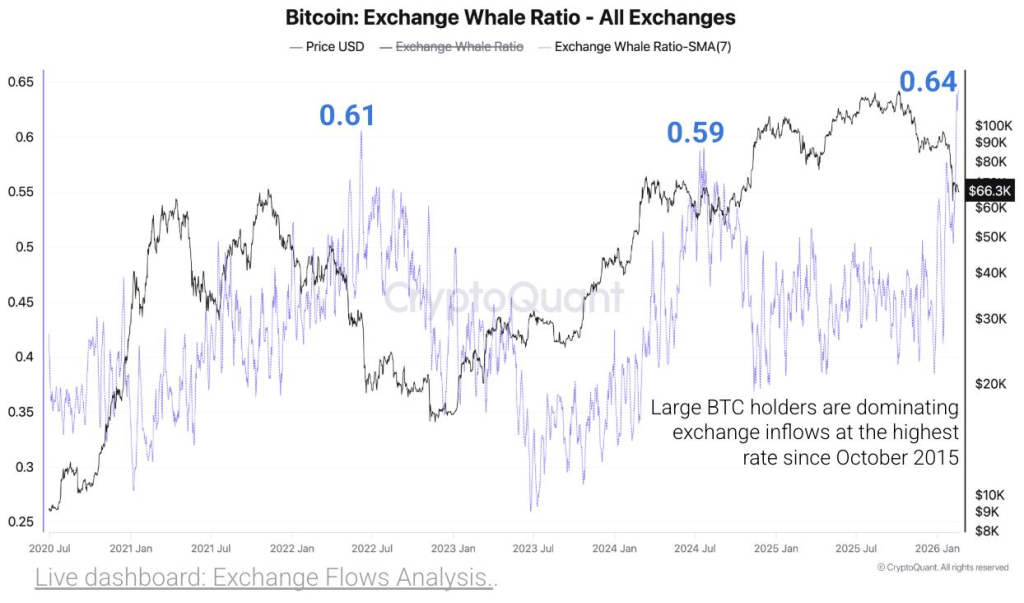

According to CryptoQuant, recent inflows to crypto exchanges have been primarily driven by large holders, as the market “remains in a bearish phase.” The share of whales has risen to 0.64, reaching its highest level since October 2015.

Simultaneously, the average daily inflow of bitcoins to trading platforms in February rose to 1.58 BTC, a record since June 2022.

Experts noted that the acute phase of the sell-off has eased, despite consistently high inflows to exchanges compared to previous months.

On February 19, following the latest recalculation, the difficulty of Bitcoin mining increased by 14.73% to 144.4 T.