The asset management division of the French banking group BNP Paribas has utilised Ethereum for a pilot project exploring the potential of tokenising financial instruments on public blockchain infrastructure.

The initiative involves issuing tokenised shares of the BNP Paribas Asset Management money market fund via the AssetFoundry platform. The digital assets are issued under a restricted access model, ensuring that only authorised participants can own and transfer tokens.

“This approach allows BNP Paribas and BNP Paribas Asset Management to assess how public networks can be integrated into regulated fund structures while maintaining the highest standards of governance, investor protection, and operational resilience,” the statement said.

The project follows the asset manager’s issuance of a similar digital product on a private blockchain in Luxembourg.

“Together, these initiatives reflect BNP Paribas’s approach to exploring different tokenisation and distribution models for more efficient service to fund managers and their investors,” the company noted.

Dubai Utilises XRP Ledger for Real Estate Tokenisation

The Dubai Land Department is launching the next phase of a pilot project for real estate tokenisation, which includes the implementation of controlled secondary trading capabilities for assets.

During the first phase of the experiment, properties worth over $5 million were digitised. The assets are available on the market as approximately 7.8 million tokens.

The government agency’s partner is Ctrl Alt, a licensed virtual asset service provider in Dubai. All blockchain transactions will be conducted on the XRP Ledger and secured by Ripple Custody.

“The secondary trading phase is intended to assess market efficiency and operational readiness, as well as to enhance transparency, governance, and investor protection,” the statement said.

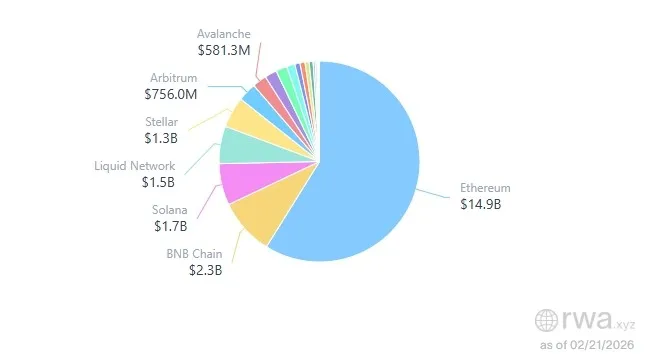

According to RWA.xyz, the tokenised asset market is valued at approximately $25 billion. Ethereum dominates with a figure of $14.9 billion, while XRP Ledger accounts for about $460 million.

Back in April, Aave founder Stani Kulechov predicted that the RWA segment could grow to $50 trillion, driven by the tokenisation of “abundant assets” like renewable energy.