Canadian firm Elemental Royalty Corporation has become the first public company in its sector to offer shareholders the option to receive dividends in digital assets backed by gold.

The company will use Tether Gold (XAUT) tokens from the largest stablecoin issuer, Tether, for these payments.

Dividends in ‘Gold Tokens’ and Sector Growth

Shareholders will have the option to receive dividends in XAUT instead of fiat currency. This provides a direct link to the gold price combined with the flexibility of digital transactions.

According to a press release, this is the first instance of its kind among public companies in the field. The initiative followed Tether’s acquisition of a third of Elemental’s shares last year.

The investment is part of the USDT issuer’s strategy to strengthen its position in the ‘real’ asset segment. According to company head Paolo Ardoino, the resilience of digital financial infrastructure requires reliance on time-tested instruments.

As part of the deal, Elemental provided Tether with “diversified access to global gold mining without operational risks.”

The Tokenized Gold Market

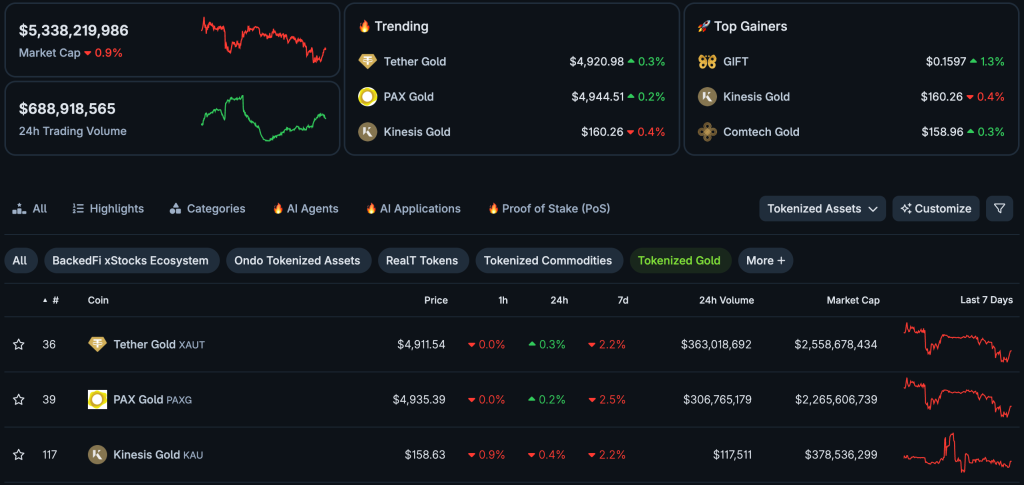

The sector is experiencing rapid growth, with total capitalization exceeding $5 billion. XAUT maintains leadership in both trading volume and supply.

Tether’s gold reserves held by the custodian amount to 520,089 troy ounces.

Ranked second on CoinGecko is PAX Gold (PAXG) with a market capitalization of $2.26 billion.

The primary growth driver of the segment is retail investors seeking access to precious metals without traditional custodians and intermediaries.

Earlier, market maker Wintermute launched over-the-counter trading of tokenized gold. Settlements for transactions are available in cryptocurrencies, stablecoins, and fiat.