On February 4, Fidelity Digital Assets launched the stablecoin Fidelity Digital Dollar (FIDD). The asset is designed for both institutional and retail clients.

We are excited to introduce Fidelity Digital Dollar (FIDD), a new stablecoin issued by Fidelity Digital Assets, NA and pegged 1:1 to the U.S. dollar.

Learn more and get started with FIDD: https://t.co/VlsKPR2BFY pic.twitter.com/wnOnXCRO03

— Fidelity Digital Assets (@DigitalAssets) February 4, 2026

“FIDD is pegged to the U.S. dollar and backed by Fidelity’s tradition of integrity and transparency,” the statement reads.

The coin was issued on the Ethereum blockchain and is expected to be listed on popular cryptocurrency exchanges soon.

Clients will be able to purchase and use the asset on Fidelity Digital Assets, Fidelity Crypto, and Fidelity Crypto for Wealth Managers platforms.

The reserves, fully composed of U.S. dollars, are managed by Fidelity Management & Research Company LLC. Audits will be conducted monthly with the participation of PricewaterhouseCoopers LLP.

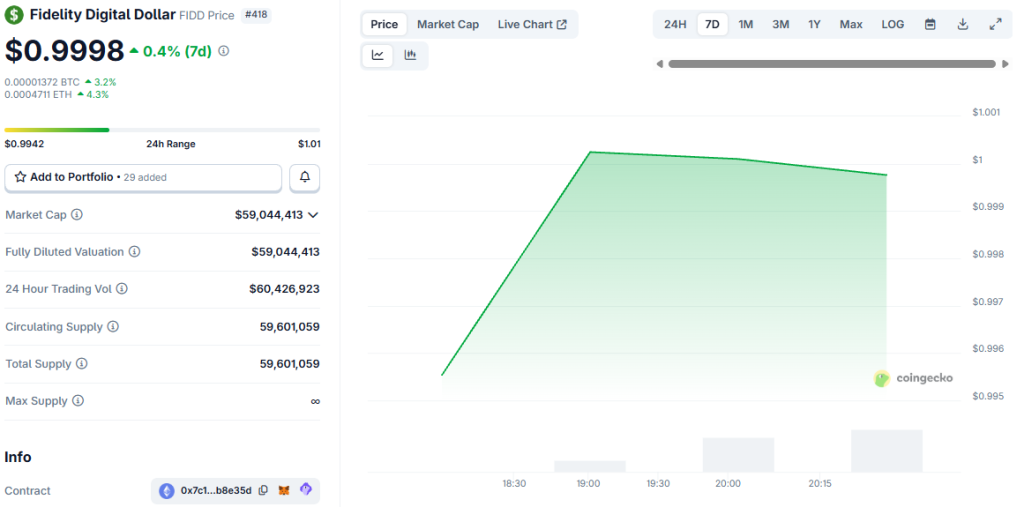

According to CoinGecko, at the time of writing, FIDD’s market capitalization is just over $59 million, with a daily trading volume exceeding $60 million.

The launch of this “stablecoin” comes amid clarifications in U.S. regulation. The Genius Act, passed in the summer, paved the way for many crypto companies to enter the local market.

“The recent approval of [the law] was a significant milestone for the industry, providing clear regulatory boundaries for payment stablecoins,” noted Mike O’Reilly, president of Fidelity Digital Assets.

Earlier in January, Tether launched the federally regulated stablecoin USAT in the U.S.