The co-founder of the decentralized exchange Hyperliquid, known by the pseudonym Iliensinc, attributed the activity of a suspicious wallet to the actions of a former employee. Previously, the community had accused the team of covertly selling native HYPE tokens.

According to Iliensinc, the address 0x7ae4…1028 belongs to an individual who was dismissed in the first quarter of 2024. This user is no longer associated with Hyperliquid Labs.

The clarification followed accusations from a community member using the pseudonym cobe.hype. In November, he discovered that approximately 4,000 HYPE, worth $134,000, had been sold from the specified wallet within a day.

One of the Hyperliquid team wallets that sold 1,200 $HYPE yesterday (0x7ae4c156e542ff63bcb5e34f7808ebc376c41028) is TWAP selling more than 3,700 $HYPE ($110k+) and still adding more to the TWAP sell order.https://t.co/ycHSEvaD6w pic.twitter.com/qoMntwjV8i

— cobe.hype (@codeboc_eth) November 30, 2025

The platform’s co-founder reiterated the company’s strict ethical standards. Current employees and contractors are prohibited from:

- trading derivatives on the HYPE token (opening longs or shorts);

- using or passing insider information to third parties.

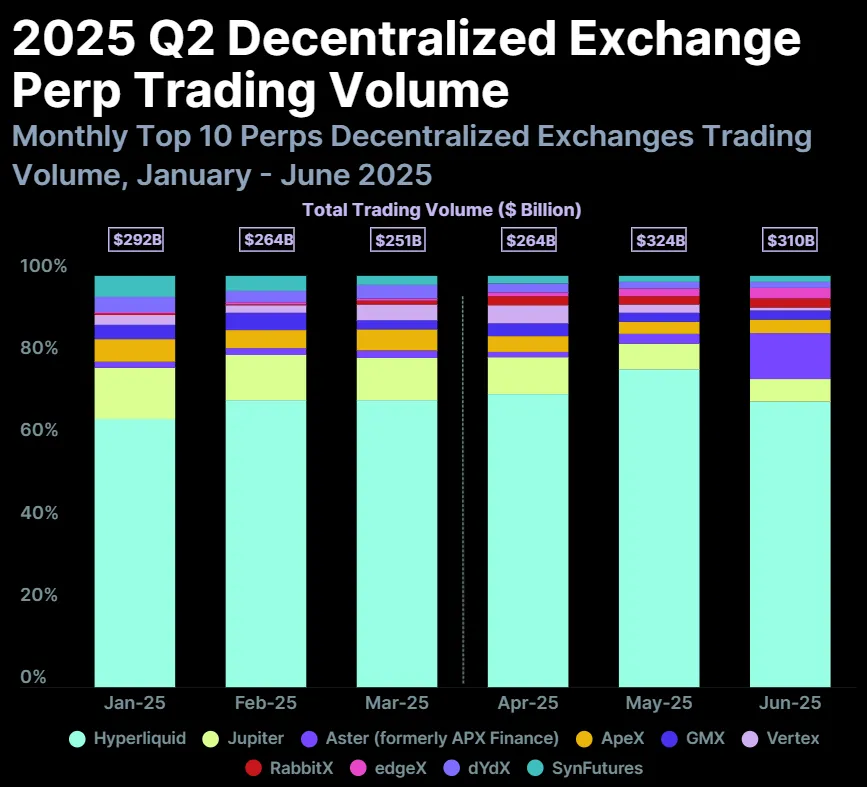

Hyperliquid maintains its leadership in the perpetual contracts segment. In the second quarter of 2025, trading volume on the platform exceeded $653 billion, with a market share of 73%.

In November, Hyperliquid suspended deposits and withdrawals amid suspicions of price manipulation of the meme coin POPCAT.