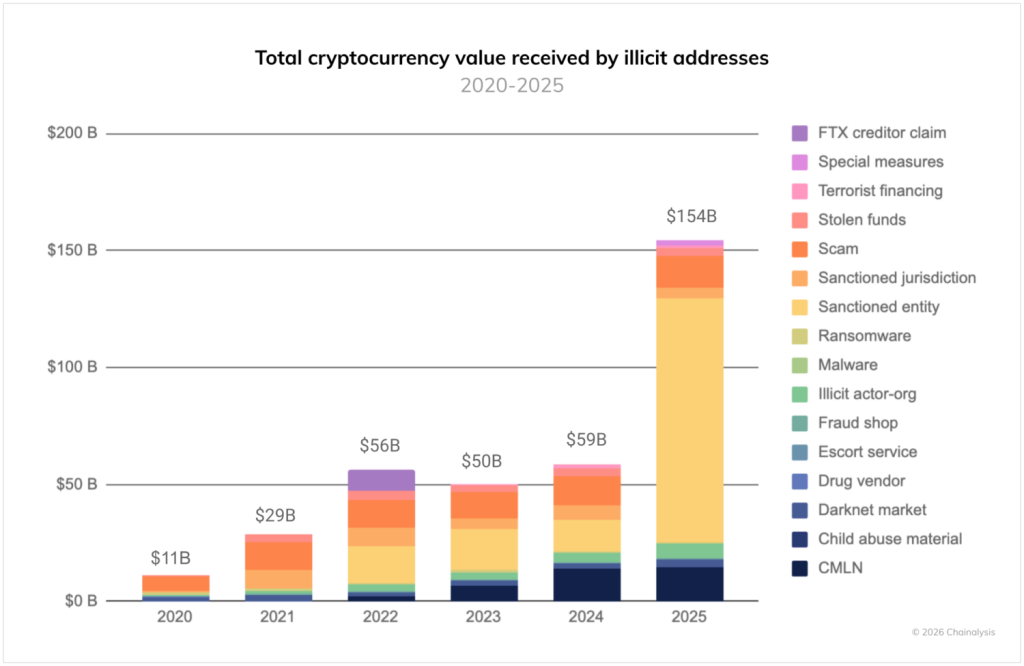

In 2025, over $154 billion flowed into illegal crypto wallets, marking a 162% increase compared to 2024, according to a report by Chainalysis.

Analysts attribute this growth largely to a surge in activity related to sanctioned operations, including at the state level. Over the past 12 months, the volume of illegal digital assets in this segment increased by 694%.

“The share of these illegal transactions remains negligible compared to the broader crypto economy, which is mostly comprised of legal operations. Our estimate of illegal transactions as a proportion of total crypto transactions has slightly increased compared to 2024, but remains below 1%,” the experts clarified.

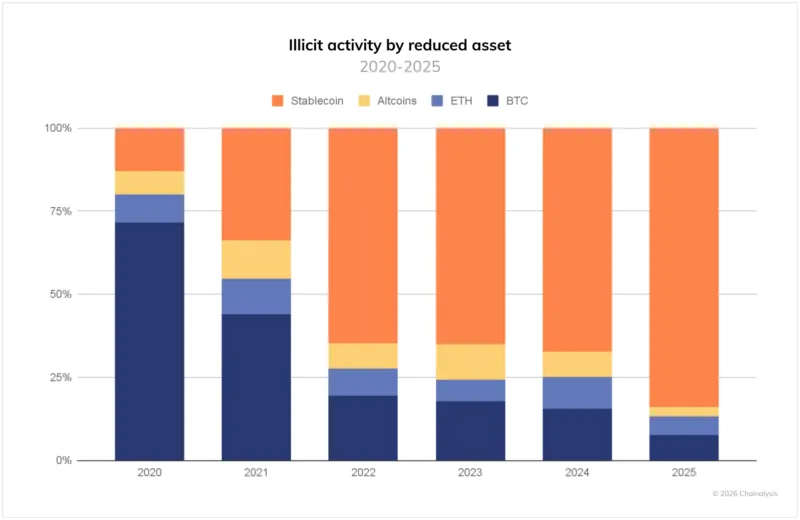

Chainalysis also noted a shift in the types of assets involved in crypto crimes. In 2025, stablecoins became the primary tool of the “black” economy (84%), whereas five years ago, it was Bitcoin.

“This reflects broader trends in the ecosystem, where ‘stablecoins’ occupy a significant and growing share of all crypto activity due to their practical advantages: easy cross-border transfer, low volatility, and broader applicability,” the researchers added.

According to Chainalysis, a significant portion of illegal turnover in 2025 was attributed to state-controlled entities.

Hackers from North Korea stole over $2 billion, marking their most successful year. The majority of this sum was obtained through the attack on the Bybit exchange.

Russia accounted for about $93.3 billion, linked to operations in ruble stablecoins to circumvent international restrictions.

Chinese money laundering networks were described by analysts as a “dominant force,” offering services and infrastructure to fraudsters, hackers, and sanctioned individuals.

Iranian proxy networks of terrorist groups conducted blockchain transactions worth at least $2 billion.

“Many still perceive crypto crimes as something virtual, like faceless perpetrators behind keyboards, rather than a real-world threat. In reality, we are witnessing a growing connection between blockchain activity and violent crimes. Digital assets are increasingly used in human trafficking, and there is a particularly alarming rise in cases of physical impact [on crypto investors],” Chainalysis concluded.

Earlier in 2025, losses from crypto phishing decreased by 83%, according to analysts at SlowMist.