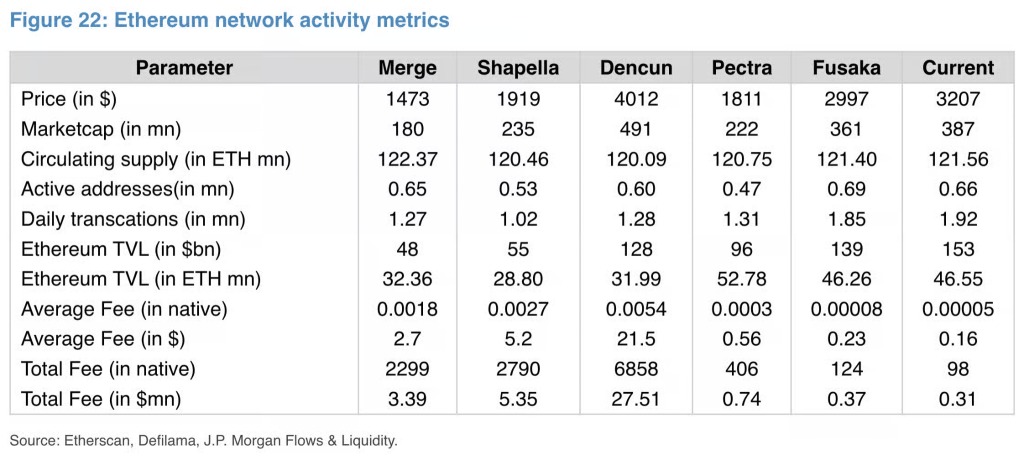

The recent Fusaka update has led to increased activity on the Ethereum network. However, JPMorgan has expressed doubts about the blockchain’s long-term prospects, according to a report by The Block.

“Historically, successive Ethereum updates have failed to significantly boost activity on a sustainable basis for various reasons,” experts noted.

They believe the first factor is the ongoing migration of users from the Ethereum mainnet to Layer 2 solutions. Citing CryptoRank data, analysts pointed out that Base alone currently generates about 60-70% of the total fee revenue in L2.

Competition from alternative blockchains is another persistent issue. JPMorgan highlighted that networks like Solana have captured a “significant” market share by offering faster and cheaper transactions, thus attracting users and developers away from the second-largest cryptocurrency by market capitalisation.

Analysts also noted a decline in speculative activity, which previously led to surges of interest in Ethereum. During the bull cycle of 2021-2022, demand related to initial coin offerings, NFTs, and meme coins contributed to increased transaction volumes. Many of these trends have since weakened or shifted to other protocols.

Moreover, capital that was once primarily invested in Ethereum is now more dispersed across specialised blockchains. Experts cited examples such as Uniswap’s transition to its own L2 blockchain and the migration of dYdX to an independent network.

“Both companies have successfully attracted liquidity to their platforms, enabling them to generate revenue from protocols,” analysts added.

The decline in Ethereum activity leads to a reduction in the volume of ETH burned from fees. This, in turn, contributes to an increase in the circulating supply of the coin, negatively impacting its prices, JPMorgan explained.

Earlier, blockchain security specialist Andrey Sergeenkov linked the record growth in Ethereum transactions to mass spam.