Despite the market’s weak start to the year, JPMorgan remains upbeat on digital assets, reports CoinDesk.

The bank expects institutional inflows and clearer regulation to be the chief drivers of the industry’s recovery.

“We are positive on the outlook for 2026 and expect increased inflows into digital assets, driven by institutional investors,” the report by analysts led by Nikolaos Panigirtzoglou says.

Correction as opportunity

JPMorgan’s analysts remain optimistic even as bitcoin slips below miners’ breakeven. Historically, that level has acted as “soft” support for prices.

At the time of writing, the leading cryptocurrency is trading around $67,390. The analysts estimate the current cost of producing one coin at roughly $77,000.

A short-term drop below the profitability threshold has weighed on sentiment and reduced on-chain activity.

If prices stay below that mark for long, less efficient miners will be forced to power down equipment. That would lower network difficulty and the average production cost. JPMorgan describes this as a market self-correcting mechanism.

Institutions versus retail

Despite the drawdown, volatility remains high. Institutional interest has proved more resilient than that of retail traders. According to the analysts, this creates a foundation for a rebound as capital rotates back into digital assets.

Bitcoin versus gold

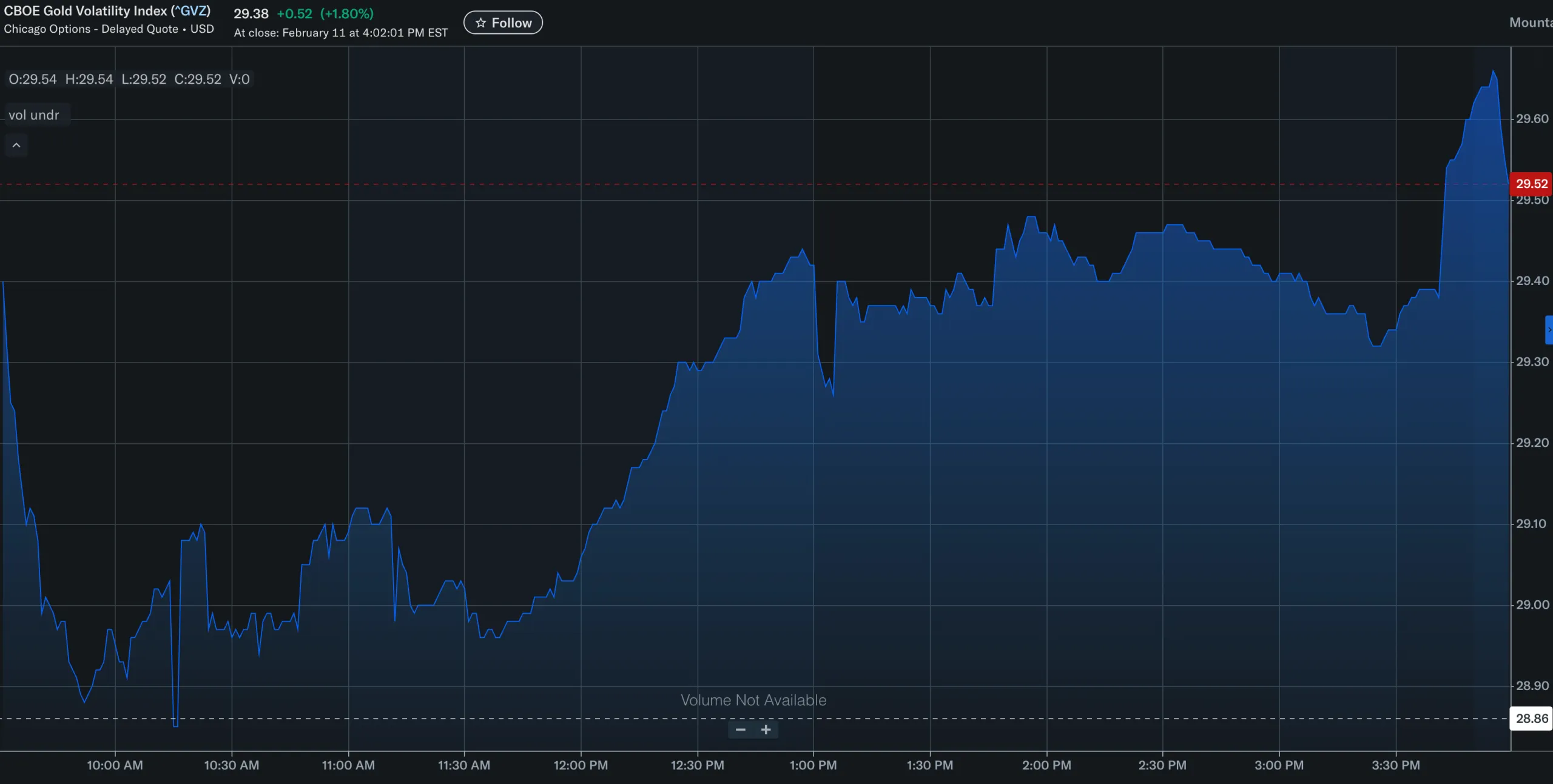

Bitcoin’s relative investment appeal has improved. Although since October gold has significantly outperformed bitcoin, the metal’s volatility has surged.

That mix makes the leading cryptocurrency a more compelling long-term instrument, the report notes.

Below is the trajectory of the CBOE Gold Volatility Index, which measures market expectations for the metal’s price swings over the next 30 days.

Outlook for 2026

JPMorgan expects inflows into digital assets to recover in 2026, led by institutional investors rather than retail players or corporate treasuries.

Additional support could come from progress on US regulation, including potential passage of new bills such as the Clarity Act.

Earlier, JPMorgan analysts expressed confidence that bitcoin could reach $266,000 in the long term. In their view, the asset is becoming “more attractive than gold”.