Billionaire Peter Thiel and his associated entity, Founders Fund, have completely sold their stake in the “treasury” company ETHZilla. This is evidenced by a Form 13G filed with the SEC.

In pre-market trading, the company’s shares fell by more than 3% to $3.51. The decline from the all-time high of $107 is approximately 97%.

Investment History in Ethereum Treasury

Peter Thiel’s entities acquired a 7.5% stake in August 2025. The transaction occurred amid the rebranding of biotech firm 180 Life Sciences and its shift towards digital assets. At that time, news of support from the billionaire triggered a 90% surge in stock prices in just one trading session.

ETHZilla launched its “treasury strategy” last summer, raising $565 million from Electric Capital, Polychain Capital, and GSR. The project was positioned as a TradFi tool for accumulating Ethereum with the potential for yield from staking.

Change of Course

Contrary to initial plans, the company shifted from accumulating assets to selling them:

- In October, ETHZilla sold $40 million worth of Ether to fund a $250 million stock buyback program;

- In December, the firm sold another 24,291 ETH ($74.5 million) to settle obligations on convertible bonds.

Focus on RWA

In December, ETHZilla noted that its market capitalization would directly depend on revenue growth in the real-world asset tokenization segment (RWA).

Since then, the company has taken decisive steps in this direction:

- Mortgage portfolio. On February 5, the firm acquired 95 loans on modular homes for $4.7 million. The assets are planned to be tokenized on the Arbitrum L2 network with a target yield of 10.36% per annum;

- Aviation engines. ETHZilla purchased two CFM56-7B24 units to issue tokens on the Liquidity.io platform—a trading system regulated by the SEC.

Ethereum Reserves

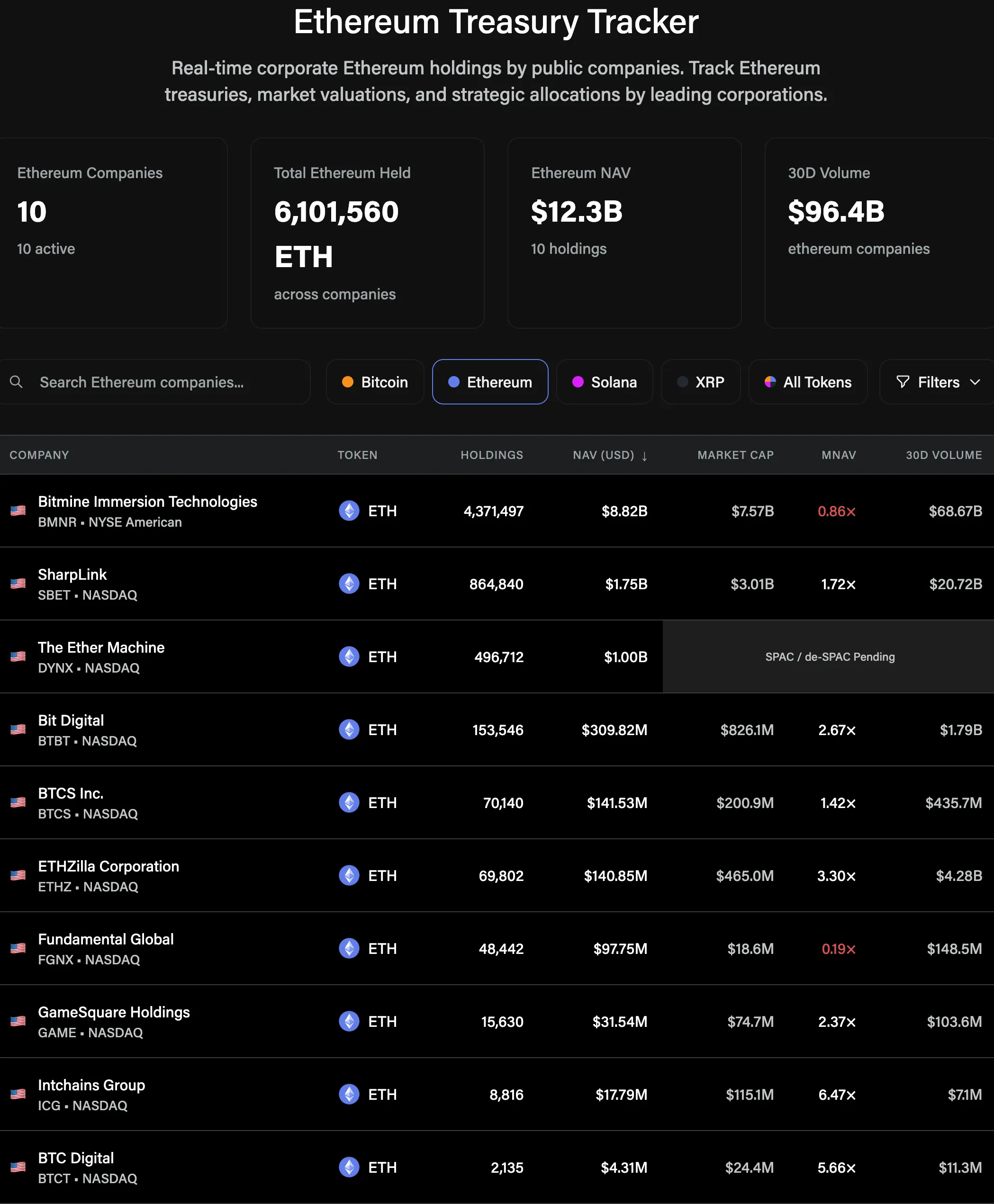

ETHZilla ranks sixth among corporate holders of the second-largest cryptocurrency. The company holds 69,802 ETH valued at approximately $140 million.

This figure is significantly lower than the leader of the list—Bitmine Immersion Technologies, which holds 4.37 million ETH valued at approximately $8.8 billion.

The total reserves of the top ten holding companies exceed 6.1 million ETH, valued at over $12 billion.

Earlier, Binance founder Changpeng Zhao called tokenization one of the most promising directions for the crypto industry.