On January 15, 2026, Christopher Wood rocked the Bitcoin boat with his weekly GREED & fear report. As the Global Head of Equity Strategy at Jefferies, Wood eliminated 10% Bitcoin allocation from his outlook, diverting it to 5% gold and 5% gold-mining stocks instead. Wood’s reasoning for this decision revolves around future quantum computing breakthroughs: […]

Michael Saylor signaled a new Bitcoin buy with his “More Orange” post on Sunday, February 1, 2026, typically preceding an official disclosure on Monday. Strategy now holds 712,647 BTC, controlling approximately 3.4% of the total supply after adding 2,932 coins in late January. Capital raising has slowed as the company’s stock hit a 52-week low […]

Bitcoin fell below $80,000 on Monday, dropping as low as $75,644 as it broke under its 21-week moving average—a key technical level that often signals a bear market. Over $2.5 billion in liquidations hammered the market over the weekend, making it the 10th-largest wipeout in history as Bitcoin fell 17% from its $90,000 January highs. […]

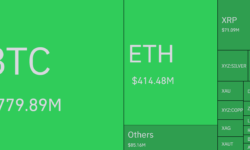

The total crypto market cap fell 6% to $2.9 trillion in a single day, marking one of the steepest declines since October 2025. Over $1 billion in leveraged positions were liquidated, predominantly longs, as Bitcoin fell below $84,000 and Ethereum slipped under $2,800. A potential US government shutdown is fueling the panic, after lawmakers failed […]

Russia will vote on a crypto rulebook in June, aiming to legalise Bitcoin for retail and institutional investors by July 2027. Exchanges will face strict licensing, with unregistered platforms facing criminal penalties and fines similar to illegal banking. Retail trading will be capped, featuring a proposed $4,000 annual limit and a “whitelist” of approved coins […]

Michael Saylor claimed the biggest threat to Bitcoin is “ambitious opportunists” seeking protocol changes, arguing that altering base rules is riskier than technical bugs. Critics like Mert Mumtaz slammed this stance as a “cancerous” mindset, asserting that software must evolve to fix vulnerabilities and remain functional. The debate further divided the community over long-term risks […]

Colombian pension manager AFP Protección will offer limited Bitcoin exposure to clients who pass a risk assessment and one-on-one advisory. The fund targets long-term diversification rather than speculation, managing a small portion of the firm’s $55 billion in total assets. This move follows a regional trend of rising adoption in Brazil and Venezuela, coinciding with […]

Bitcoin returned to $90,000 and US stocks rallied after President Trump canceled planned EU tariffs following a “framework” deal for Greenland. The diplomatic shift in the Arctic dispute eased global trade-war fears, causing market volatility to subside from earlier session highs. As risk appetite returned to equities and crypto, safe-haven assets like gold flattened, losing […]

Ark Invest’s “Big Ideas 2026” report projects Bitcoin will reach a $16 trillion market cap by 2030, driven by institutional adoption and ETF growth. The forecast assumes a 63% compound annual growth rate, with Bitcoin increasingly capturing the “digital gold” market as its volatility declines. Smart contract platforms are expected to reach a $6 trillion […]

Boundless has introduced a cross-chain system that settles zero-knowledge proofs from Ethereum and Base on Bitcoin without changing Bitcoin’s protocol. The design uses BitVM and Citrea to verify off-chain computation while keeping execution on smart contract chains. The approach reflects a broader shift toward using Bitcoin as a neutral settlement and security layer for rollups. […]