A turnaround in the meme token segment might occur sooner than traders anticipate, according to Santiment.

Analysts noted that a narrative of “nostalgia” is gaining traction on social media regarding “funny coins.” Many users consider the sector to be definitively dead.

“This collective acceptance of the ‘end of the meme era’ is a classic capitulation signal. When the crowd completely writes off a sector, it is often the moment to pay attention again,” Santiment specialists emphasized.

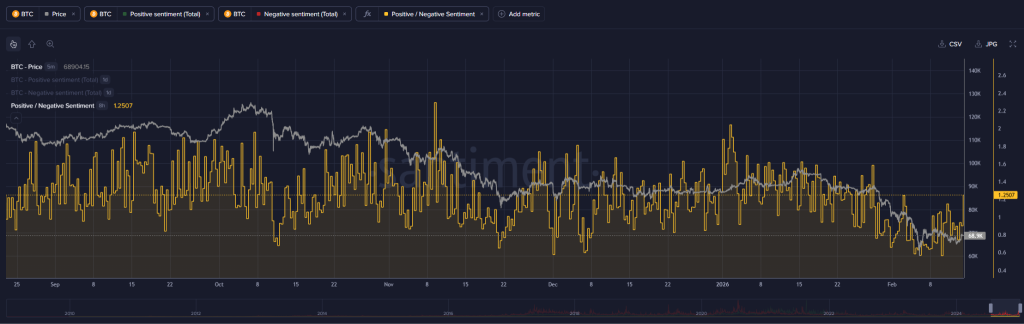

Concerning the digital asset market as a whole, sentiments remain anxious, with negative comments prevailing.

“Historically, markets move contrary to crowd expectations. This persistent distrust even during price increases is a healthy sign of potential sustainable recovery,” analysts added.

According to CoinMarketCap, over the past 12 months, the capitalization of the meme coin segment has decreased by 56.5% to $31.3 billion. Trading volume during this period plummeted by 69%.

In January, CoinGecko experts reported a record “mortality” of tokens in 2025, with 11.6 million coins collapsing. They linked the trend to market volatility and the collapse of the meme coin sector.

What About Bitcoin?

Following the release of unexpectedly positive consumer inflation data in January by the U.S. Bureau of Labor Statistics, the leading cryptocurrency surpassed the $69,700 mark during a local rally.

The cooling trend in price growth in the world’s largest economy “rekindled hopes for a Fed rate cut in 2026,” Santiment noted.

“While the immediate reaction is bullish, macroeconomic reports rarely determine long-term cryptocurrency price trends on their own,” experts stated.

In their view, although the momentum appears “encouraging,” Friday’s price jumps on economic news often require trend confirmation at the start of the following week.

Santiment specialists pointed out that the collapse in trading volumes indicates a state of capitulation and “analysis paralysis” among traders. This is a potential signal of the market preparing for the next significant move. However, continued purchases of the leading cryptocurrency by retail investors suggest that the bottom has not yet been reached.

CryptoQuant analysts also questioned the end of Bitcoin’s correction. They noted that historically, the lower boundary of a bear market is defined by the realized price of the asset, which is $55,000.

Standard Chartered suggested a dip in digital gold to $50,000. However, the year-end forecast for the flagship is $100,000.

Jean-David Pekino, Chief Commercial Officer of the derivatives exchange Deribit, believes that Bitcoin’s long-term rally is “broken.” There will be no sustainable recovery until the asset rises above $85,000, he stated in an interview with CoinDesk.

On February 6, the first cryptocurrency’s quotes fell to $60,000. This mark, along with the 200-week moving average, which is now $58,000, is a significant support level, the expert emphasized. A price drop below these values will open the way for a deeper correction, Pekino believes.

In early February, Bloomberg Intelligence’s senior commodity strategist Mike McGlone reiterated his forecast of a potential drop in the leading cryptocurrency to $10,000 this year.

Analysts at K33 Research identified $60,000 as a local bottom for Bitcoin.