Analysts at Standard Chartered have lowered their short-term forecast for cryptocurrencies, warning of a potential continued correction with a recovery by the year’s end. This was reported by The Block, citing the company’s report.

“In the coming months, we will see more challenges and the final capitulation of digital asset prices. The macroeconomic situation is unlikely to provide support until we approach the appointment of Kevin Warsh as head of the Fed,” said Geoffrey Kendrick, head of cryptocurrency research at Standard Chartered.

The expert anticipates Bitcoin falling to $50,000 and Ethereum to $1,400. In his view, investors will start buying actively at these levels.

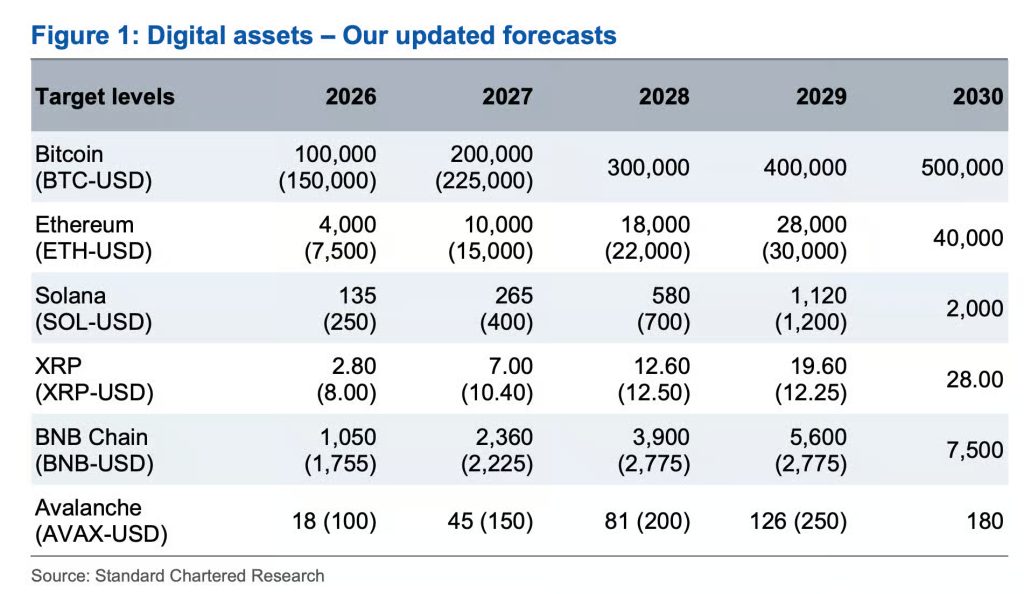

By the end of 2026, Kendrick forecasts a recovery in the prices of leading coins to $100,000 and $4,000, respectively.

The analyst also lowered target levels for other digital assets:

- Solana — $135 (previously $250);

- XRP — $2.80 (previously $8);

- BNB — $1,050 (previously $1,755);

- Avalanche — $18 (previously $100).

The Standard Chartered analyst noted that the digital asset class will remain under pressure in the short term, but the broader forecast remains unchanged.

Factors Behind the Decline

Kendrick identified the behavior of Bitcoin-ETF investors due to unrealized losses as a primary reason for the market’s negativity. According to the expert’s estimates, the volume of assets in the funds has decreased by nearly 100,000 BTC since the price peak in October 2025.

Macroeconomic conditions are also exerting pressure on sentiment. Recent US economic data points to mixed prospects, and market participants do not expect interest rate cuts.

Standard Chartered believes the current situation may hinder new investments in cryptocurrency in the coming months.

Despite the pessimistic short-term outlook, Kendrick noted that the current decline is less severe than in previous cycles. The absence of major collapses and bankruptcies indicates a more resilient crypto market.

Earlier, analysts at K33 Research observed signs of investor capitulation simultaneously in the spot market, the ETF sector, and derivatives.