Bitcoin infrastructure firm Voltage has launched a programmatic revolving credit line, Voltage Credit.

Today we’re launching Voltage Credit. 👀

The industry’s first programmatic revolving line of credit built on top of Bitcoin payment rails. ⚡

Send payments with instant finality over BTC/Lightning.

Repay your credit line in USD from a standard bank account or in Bitcoin.

Pay…

— Voltage ⚡ (@voltage_cloud) February 19, 2026

The product lets businesses send instant payments over Lightning Network (LN), repaying balances in dollars from a standard bank account.

The tool is aimed at companies that want to use the micropayments network without holding digital assets on their balance sheets. In comments to The Block, Voltage representatives said the project is meant to address a longstanding problem in corporate finance.

The killer feature

Conventional banks typically do not extend credit against income denominated in digital gold. Meanwhile, crypto lending platforms require locking up bitcoin as collateral, creating tax risks and exposing capital to the swings of a volatile asset.

Voltage’s solution relies on assessing a borrower’s revenues. Credit limits are set and adjusted according to the client’s actual transaction volumes within the company’s infrastructure.

“Until now, using bitcoin for payments meant managing cryptocurrency on the balance sheet. Voltage Credit removes that trade-off. Make instant payments over Lightning in dollars or bitcoin depending on business needs and direct capital toward growth. This is what bitcoin infrastructure for enterprises should look like,” said Voltage CEO Graham Krizek.

The company specified that it charges no fee for opening the credit line. A fixed annual rate applies to the outstanding balance.

News of the new product arrived shortly after a $1 million transfer in LN between Secure Digital Markets and Kraken using Voltage’s infrastructure. The first seven-figure payment in the network was processed virtually instantly with minimal fees.

Infrastructure and payments on the Lightning Network

Lightning Network is a second-layer (L2) protocol for the Bitcoin network that enables transactions off the main blockchain.

A user opens a payment channel with a standard on-chain transfer and can then make numerous instant operations within the network. When it is closed, the final balance is settled on the base layer (L1). This solution significantly reduces fees and speeds up processing.

Analysts at Fidelity have called LN an effective approach to scaling payments on the Bitcoin network. In their view, the protocol’s capabilities already extend beyond simple P2P transfers. In 2024 the number of business integrations grew, confirming demand for the protocol for small-value digital-asset transactions.

In recent years and months, well-known platforms have added Lightning support. In April last year, the crypto exchange Coinbase integrated micropayments and later said the protocol accounted for 15% of the platform’s bitcoin-transaction volume. The fast-food chain Steak ‘n Shake bought $10 million in bitcoin eight months after launching LN payments in all its U.S. restaurants. The new option helped the company increase sales by 15%.

Traditional financial services are increasingly adopting Lightning infrastructure too. In August 2025 the fintech company SoFi integrated Lightspark’s solutions for international money transfers. The real-time system converts dollars into bitcoin, routes funds over LN and immediately exchanges them into the local currency.

On 11 February Lightning Labs released an open-source toolkit. It allows AI agents to operate LN nodes and make payments without identification and API keys. The release included seven compatible modules: with them autonomous systems can programmatically work with nodes and pay for requests using the L402 standard.

Mixed metrics

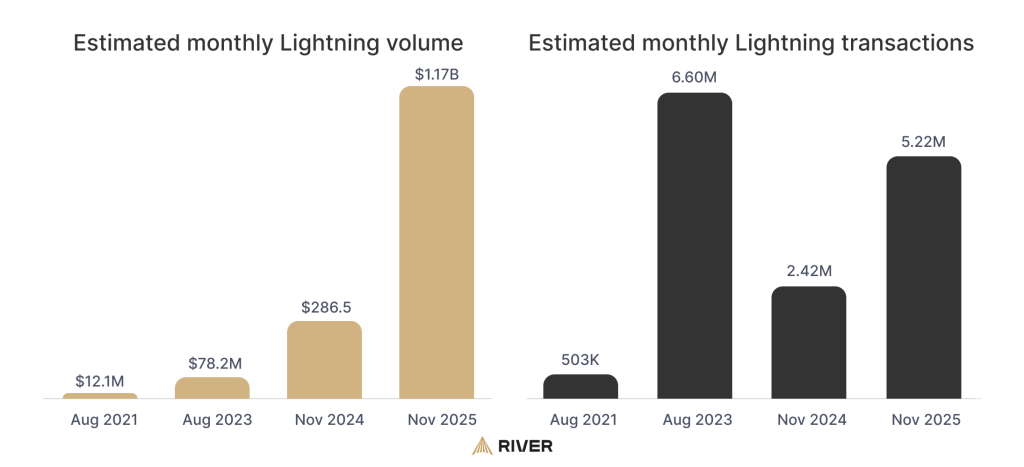

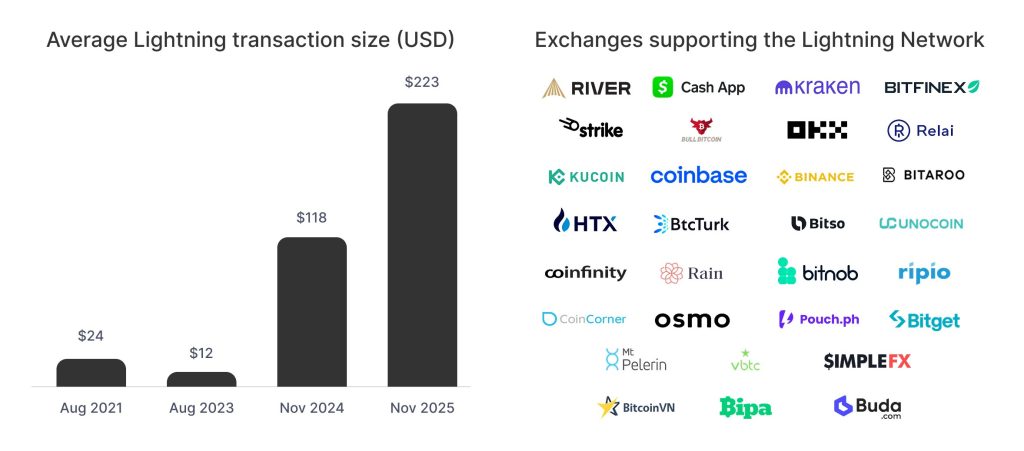

According to a report by River, in November the value of Lightning payments crossed the $1 billion mark. However, the number of transactions that month was about 21% below the level of August 2021 (5.22 million versus 6.6 million).

A possible explanation is the substantial increase in the average transfer size thanks to broad support for the network by major exchanges:

“Today, the primary use case for Lightning transactions is exchange deposits and withdrawals. As a rule, these are large-sum operations,” the researchers explained.

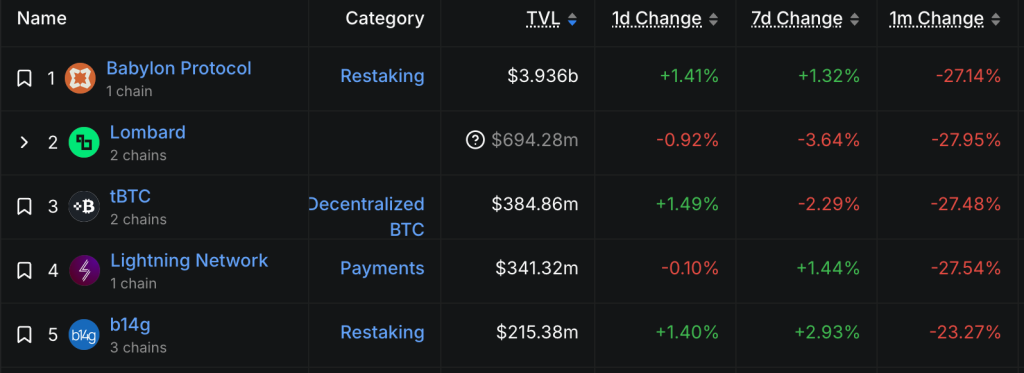

In early January, LN capacity in dollar terms exceeded $500 million, after which it fell to roughly $340 million. In the same month, the figure in bitcoin reached a high above 5700 BTC — 55% more than the trough of 3730 BTC recorded in August last year.

In the context of DeFi, the micropayments network’s capacity looks rather modest compared with the TVL of leading BTCFi protocols such as Babylon or Lombard.

At the time of writing, the Lightning Network has 15,716 payment channels linked by 5,335 nodes, according to 1ML.

Earlier, Amboss Technologies unveiled the RailsX LN platform for P2P trading.